First cash flows from our stock holdings

January really was a strong month in terms of passive income showing a 250 % jump compared to the previous year.

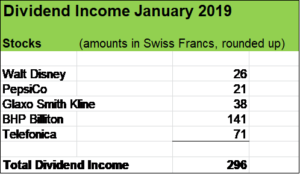

My wife and I are happy to see five fine companies paying us the total amount of almost USD 300.

Mining giant BHP Billiton made a special dividend distribution. But even without that extraordinary effect, our dividend income would still be 30 % above the previous year.

Compared to last year, PepsiCo is a new passive income contributor in our portfolio. PepsiCo really is one of our favorite stock acquisition, showing a strong dividend history (last increase was by 15 %).

Disney showed good organic growth as well, boosting its payout by 7.7 %. British pharmaceutical company GlaxoSmith Kline and Spanish telecommunication giant Telefónica held their payouts steady.

Our current projected passive income for 2019 stands at around USD 9’000. Our goal is to smash the USD 10’000 mark over the course of the year, laying the basis for the next leap to USD 15’000 in 2020.

So, boosting our dividend paying cash machine is one of our financial priorities.

November and December 2018 were great months to buy stocks

January showed a nice recovery of stock markets from their pretty sharp decline late in 2018. The market value of our share portfolio has been significantly pushed up in just a few weeks and currently sits at around USD 255’000.

The flip-side of that recovery is that once again it is harder to find extremely attractive investments.

We clearly prefer to buy stocks of quality businesses when their prices have come down.

In November and December 2018, we have been very busy to put roughly USD 25’000 to work. We took advantage of last year’s market correction by quite intensively buying stocks of businesses we considered as attractive investments at these lower prices. We made some new additions and also increased existing holdings. Just to name some of our latest investments:

- French insurance company AXA

- Luxury goods conglomerate Moet Hennessy Louis Vuitton (LVMH)

- Mining giant GLENCORE

- British American Tobacco

- Special chemical producer Covestro

- Pharmaceutical and life sciences company Bayer

My wife and I will keep our systematic investment approach, fueled by a robust savings rate of well above 50 %. And when share prices fall, we are particularily happy to put more cash to work transforming it into productive assets.

First stock buy of the year

In January, we piled up our existing position in duty free retailer Dufry by investing an additional amount of roughly USD 4’000.

We like Dufry as an investment which has in my view the potential to become an interesting income play over the medium term. With a market share of already roughly 20 % in the airport retail sector, there is some regulatory limitation to push that growth further.

Dufry has been an incredible growth story over the last decade. Through a combination of organic growth and several acquisitions, they have reached a market share of 13% in travel retail and as said, Dufry operates 20 % of all airport duty free shops worldwide. The company’s geographic diversification is just massive.

Today, I see Dufry less a growth company than a deleverage story. To finance its massive expansion strategy over the last decade, Dufry took on a significant debt pile. By deleverage story I mean that Dufry has the potential to generate very attractive shareholder returns simply by focusing on

- efficiencies and organic growth,

- paying down debt and

- sending excess cash to shareholders.

Some other examples in our portfolio we also consider as deleverage stories include businesses like Chevron, Royal Dutch Shell, British American Tobacco, Imperial Brands and Anheuser-Busch InBev.

In the case of Dufry it is pretty interesting watching how markets react to the company’s switch from “growth modus” to “profitability and deleverage modus“. In 2016, the stock price was above CHF 160 and currently sits at around CHF 100. But here’s the thing: cash flow generation is significantly stronger today and strong net debt decrease drove net debt/EBITDA from over 4x in 2016 to below 3x.

Yes, Dufry operates in a challenging environment, and its future growth will be a far cry from the last decade.

But what I see is a clear market leader in the growing travel industry, and clearly Dufry is much more profitable today with less financial risks than a few years ago. And the best of all is that its stock trades 40 % lower than a few years ago.

And as said, when price levels get lower, we love to invest in quality businesses.

What about you, fellow Reader, how was your January in terms of passive income? What do you think about our recent stock acquisition?

Thanks for reading my post and for sharing your thoughts.

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Thanks for sharing your results and your purchase. Cheers

Hey BHL

Thanks for swinging by.

Cheers

Hi FS,

What a great start to the new year! The $10,000 mark is already within sight. And I’m pretty sure you’ll over-accomplish your annual goal.

I think most of us dividend growth investors experienced the same mixed feelings between December 2018 and January 2019. Sure, it’s comforting to see one’s own portfolio value going up again. But I would have loved to see stock prices go down even further, because – as you correctly stated – now it’s again much harder to find attractive valuations.

I also like the idea behind your deleverage stories. As a shareholder of Royal Dutch Shell and British American Tobacco, I really wouldn’t mind a little bit less debt on their balance sheets.

– David

Hi David

Thanks for stopping by and commenting!

Yes, 2019 really showed an amazing start and I just can’t wait to smash the USD 10’000 milestone. With significantly more elevated stock prices its getting harder to make the next leap in terms of passive income. The risk of overpaying is much higher.

With respect to the delevaraging plays: yes, with every billion Royal Dutch, British American Tobacco pay down debt, they not only slash their risk position and gain more financial flexibility but they significantly boost their free cash flow. It’s really a virtuous cicle, financing costs sink further making the deleveraging process stronger and stronger. Not every business is strong enough though, just looking at KraftHeinz, huge debt pile which could not been brought down despite industry leading margins.

Cheers