This blogpost may contain affiliate links.

Hey there, fellow Reader! I hope you are having a phenomenal summer time!

Back from three great holiday weeks in Italy and Switzerland with my family, I’m glad to share with you how we are establishing a second passive income machine, which will – in addition to our stock portfolio – churn out cash on a monthly basis.

Putting our “parking money” to work

Over the past few years, my wife and I have been working pretty hard on

- increasing our savings rate and

- regularily putting money into dividend paying stocks to generate passive income.

This has worked out very nicely, our share portfolio is now “producing” more than USD 10’000 in dividend income in 2019 alone and what’s best: that amount has the potential to grow by roughly 10 % annually just through dividend hikes of our stock holdings and by consistently reinvesting received cash into existing or new postions.

We will continue investing heavily into dividend paying stocks and are really looking forward to seeing our share portfolio grow year by year.

In addition, my wife and I have been putting aside a nice cash pile over the last ten years. We had initially planned to invest these funds into one or several real estate projects in Central Europe.

But roughly one year ago, my wife and I took the decision to put back our real estate plan(s).

WHY?

Well, we just couldn’t identify real estate objects in central Europe where we would feel comfortable investing in.

Real estate markets seem WAY overheated and the imminent possibility of severely overpaying is just not worth the risk. We will certainly not jeopardize our dream to reach Financial Independence – which is in full reach and only a matter of a few years – by buying one or more houses for a crazy price.

But what to do with our cash pile instead? How to make use of it?

First and foremost, cash provides us with tremendous flexibility in our life and let’s us take advantage of investment opportunities when they arise.

A portion – in the amount of roughly USD 40’000 – of our cash has been put into corporate bonds a few years ago. This “parking money” has so far been generating roughly USD 500 in annual interest income and these bonds will run off this August and September.

My wife and I have been thinking pretty hard how to use that “freed cash” effectively while remaining as liquid as possible.

Of course, shares of businesses like Nestle, Diageo, Unilever, Royal Dutch Shell, Chevron, Swiss Re, Coca Cola, Heineken, Reckit Benkiser etc. can be sold easily. But for us these are stocks we want to hold for decades.

So, my wife and I took the decision, not to put the USD 40’000 into stocks and agreed on following capital allocation instead:

- USD 10’000 will be added to our cash pile and

- USD 30’000 will be put into two Peer to Peer (P2P) platforms (USD 15’000 in each)

For us, it’s a good mix between the three trade-offs

- risk,

- reward/rentability and

- liquidity

What is Peer to Peer Lending?

Peer to peer lending which is abbreviated with P2P lending is the practice of lending money to individuals or businesses. It usually works through online services resp. platforms that match lenders with borrowers.

With P2P, you as an investor, you kind of become the Bank!

P2P companies resp. platforms offering these services generally operate online and can run with a significantly lower cost basis and provide the service more cheaply than traditional banks. That cost advantage is one reason (of course not the only one) why through P2P very attractive interest returns (over 10 % annually) can be achieved.

Investing into P2P platforms Bondora and Mintos

Bondora’s product “Go and Grow”, a very liquid P2P investment

I target a total investment of USD 15’000 into the platform Bondora by the end of September and have started in August with transferring funds.

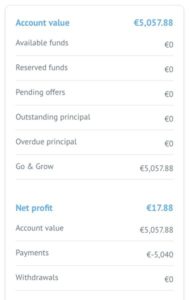

Some interest income has already been generated as you can see from the screen-shot (account statement as of 17.8.2019):

A few information about Bondora:

This Estonian P2P platform has been established around 10 years ago and has been hugely successful.

Today, Bondora is one of the leading consumer loan providers in continental Europe. Bondora offers unsecured consumer loans marketed in Finland, Spain and Estonia via a fully digital process.

There are currently more than 73’000 investors using the platform to invest in a loan volume of currently around EUR 250 millions.

What’s interesting for investors is that the minimum investment amount is EUR 1, which means that it is possible to diversify very broadly over many different consumer loans.

Bondora offers an automatic investment device, which can be calibrated. You can put a filter according to your individual riks-reward-profile and funds are then invested automatically resulting in a very diversified credit portfolio.

The offered investment services are free for investors which makes it even more attractive.

Just to be clear: investing into P2P platforms comes with various risks!

As a lender your main risk is that the borrower does not pay back the money.

In P2P a certain number of loans won’t be paid back. But with high returns on other loan investments, it can be compensated and overall give good results.

So, risk management is key, each investor has to find his or her individual balance between risk and reward.

And here I have to say, that the platform Bondora offers great flexibility and interesting features resp. products.

Investors can invest directly into consumer loans or use a autopilot etc. and for my wife and me one product really is hugely interesting to start with: Bondora “Go and Grow”.

Bondora “Go and Grow” has some similarities to a bank savings account, but of course with higher risks.

Investors putting money into Bondora’s “Go and Grow” get an attractive return of 6.75 % per year. What’s really interesting for us is the fast liquidity, meaning that one can cash out his or her funds with minimal effort (there is just a flat withdrawal fee of EUR 1 regardless of the size of the account).

With “Go and Grow“, the investment process into consumer credits kind of happens in the background. By putting money into “Go and Grow”, you are investing in fractions of a portfolio consisting of a universe of loans issued by Bondora. There are tens of thousands of them, so there is a massive diversification over countries, regions, risk profiles etc.

I’d guess that Bondora can quite consistently generate roughly 15 % and keep the difference (Bondora’s investment returns minus the 6.75 % paid to investors), translating into a nice profit margin for the company.

It’s also worth noting that the 6.75 % interest rate is not guaranteed. It can be lowered depending on the returns Bondora is able to generate. But my guess is that the company will work hard to keep the interests paid to investors as consistent and stable as possible.

For us, Bondora’s feature “Go and Grow” has been ideal to start P2P investing.

What’s important for my wife and me is to remain liquid to a certain extent while collecting nice interest payments of 6.75 % annually.

If you would like to add Bondora to your P2P porfolio, you can use this link to register and you will receive free EUR 5 on your Bondora account, ready to invest.

Finding our risk – reward balance with Lituan P2P giant Mintos

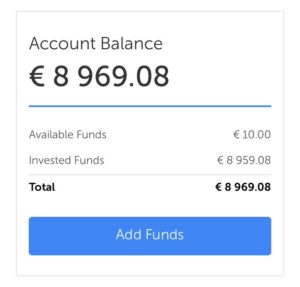

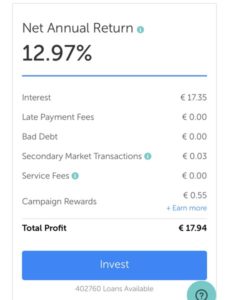

I target the deposit of a total of USD 15’000 into the platform Mintos by the end of September and have already put some funds to work, as you can see on the screen shots (as of 17.8.2019):

I’ve been following the development of Mintos on the sideline for some month now and it’s just amazing how this company has developed.

Just think of that: 170’000 investors from more than 70 countries have been putting their money into the platform so far, that’s more than double compared to Bandora.

Loans funded amount to 3 Billion Euro (!), there is huge number of different loans one can invest in. There are several types of loans offered on the platform, from business loans to acricultural-, car-, mortgage loans etc.

The minimum investment amount is EUR 10, the services are free of charge.

For instance, an investor can put EUR 1’000 into 100 different loans, diversifying broadly into different loan types, countries, risk profiles etc.

In addition to that huge diversification possibility, most of the loans on Mintos are offered with a so-called “buyback guarantee” from the loan originators.

What does that mean?

Mintos, in contrast to Bondora, does not issue loans. Mintos is a global online marketplace for loans, currently issued by over 60 loan originators (e.g. leasing companies etc.). Minto’s business model entails a total of four participants; the platform AND the loan originators are between the lenders/investors and the borrowers.

The fact, that loan originators are integrated into Minto’s business model is a huge difference compared to the model of Bondora and in my view the key success factor. Mintos can grow litterally exponentially, while remaining lean and agile.

The so-called “buyback guarantee” means that if repayments of loans are delayed by 60 days, then the loan originator has to buy back the loan. So, there is to some extent a protection of investors against defaulting loans.

Personally, I prefer calling it “buyback promise from loan originators”. As we all know, when it comes to investing, in fact nothing is guaranteed. When the loan originator goes bankrupt, then a “buyback guarantee” does not work and the risk of defaulting loans comes back to the investor.

But the system of “buyback guarantee” is in my view a good way to mitigate some of the risks from the investor’s side and clearly gives an incentive to the loan originator to implement a very good process when granting credits.

What’s also worth noting is that the loan originators have to keep “skin in the game” of at least 5 % which means that they always have to keep involved into the credits they sell on Mintos to investors. This is another mechanism to ensure that the interests of us investors and loan originators are aligned.

Mintos offers another very interesting feature, a so-called secondary market on which investors can sell their loans (resp. fractions) to other investors.

The existence of a secondary market provides liquidity. When an investors needs some immediate cash, she or he does not have to wait until a loan comes due but can sell some loans instead. Of course it always depends on supply and demand, sometimes a discount has to be granted, especially when the disposal has to take place in a short time period (e.g. within a few hours).

Next steps to build our P2P portfolio

As said, by end of September I will have invested USD 15’000 in each of the two P2P platforms (Bondora and Mintos) which will add nicely to our passive income.

My wife and I are currently in the “testing phase” when it comes to P2P investing. As soon as we feel comfortable enough, we might consider putting another amount of USD 30’000 to work. This total of USD 60’000 invested into P2P has then the potential to generate over USD 6’000 in interest income annually resp. USD 500 per month!

We might also consider adding one or two additional P2P platforms to our portfolio over the next weeks.

I am really looking forward to share with you our next monthly passive income update in my next blogpost, showing the received dividends from our stock holdings as well as our interest income from the two P2P platforms Bondora and Mintos.

This blogpost may contain affiliate links.

What about you, fellow reader? Have you made some experiences with Peer to Peer (P2P) Lending? Which platform(s) do you us and why?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Very nicely done. I was thinking about P2P lending soon as well. Not sure how much I’m willing to invest, plenty of research to do in the meantime.

Hey BHL

Yes, it definitvely requires some research, but there is plenty of very good resources and we took our time. I think it’s important not to rush in. One great thing with P2P platforms is that it’s possible to make investments with smaller sums and scaling it up once one feels more comfortable.

I’m very excited to see how our P2P investments will develop over time.

Thanks for stopping by and commenting!

Cheers

What a coincidence! Although I haven’t it made public yet, I just made the same move and invested part of my cash pile into Bondora Go & Grow!

My motivation for entering the P2P field is pretty much the same as yours.

My next step is to diversify my P2P investments over more than just one platform. I think I will go for Mintos next.

Do you already know Lars Wrobbel’s Blog/Podcast yet: https://passives-einkommen-mit-p2p.de/ueber-lars-wrobbel/?

It helped me a lot to gain further knowledge about the specific P2P platforms.

What were your main sources of information?

– David

Hi David

That’s pretty coool, you chose P2P as well to make some of your cash generate passive income! Looking forward to share our experiences!

I am also considering to add one or more platforms to my initial investments into Mintos and Bondora. I want to find a good mix of diversification while keeping things as simple as possible, I don’t want to have an eye on 20 platforms and want to limit things on four to five.

With regard to sources of information I like to read platform reviews and comparisons such as https://alternativeinvestments.com/p2p-lending-platforms-comparison/ and blogs like https://rethink-p2p.de. There are also quite cool podcasts and resources on youtube.

Thanks for swinging by and commenting.