Hey there, fellow reader. It’s time for our passive income update and I am super excited to share with you our latest moves and progress we made in terms of dividend growth investing and Peer to Peer Lending (P2P).

As shared in my last blogpost, we startet our P2P portfolio early in August.

Let’s have a brief look back

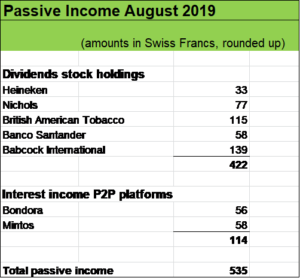

From January to August, my wife and I have collected over USD 9’400 from following three sources:

- dividends: USD 8’905

- interests from corporate bonds: USD 400

- interests from P2P platforms Mintos and Bondora: USD 114

Our 2019 passive income goal of USD 10’000 is in full reach, in fact, we will surpass that milestone next month!

The numbers I share with you are net after taxes and denominated in Swiss Francs resp. in USD (CHF and USD trade more or less trade at parity).

Over the past few years, the lion share of our passive income has been from dividends.

In future, there will be a second passive income machine – our P2P Portfolio – which will also contribute to our income.

August shows strongest Year over Year passive income growth ever

Compared to August 2018, our passive income increased three fold from USD 171 to over USD 504.

This was due to a combination of five factors:

- organic dividend growth,

- dividend reinvestments into existing postions,

- topping up existing stock holdings (British soft drink maker Nichols & British American Tobacco)

- addition of one new stock holding, contributing the first time in August (British defense business Babcock International)

- and last but not least: set-up of our second passive income machine (P2P portfolio consisting of investments made on Mintos and Bondora)

Let’s go a bit deeper into the numbers.

250 % year over year dividend income jump

British defense company Babcock International is a relative new holding which gave a strong boost to our portfolio’s passive income generation in August.

Organic dividend growth of our August dividend contributors was quite robust as well. Compared to 2018, following businesses hiked their payouts:

- Heineken: + 8.8 %

- Nichols: + 14.5 %

- British American Tobacco: + 4 %

- Banco Santander: + 5 %

Amid good organic dividend growth there have been very strong currency headwinds.

The British Pound has devaluated significantly, by 8 %, against the Swiss Francs over the last two months. The Euro weakened as well against the CHF.

Without these adverse currency exchange movements, our dividend income of Nichols, British American Tobacco and Babcock International would have been roughly USD 26 higher.

USD 114 from P2P platforms Mintos and Bondora in August

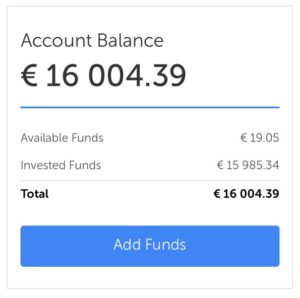

In August, we invested over several installments roughly EUR 15’950 (ca. USD 17’450) into the P2P platform Mintos. That amount is a bit higher than the USD 15’000 which we had initially planned (see last blogpost). We might scale back to that level by the end of the year, but in the meantime we want to see our money produce more money on Mintos.

So far, over the last four weeks, roughly EUR 53 (ca. USD 58) interest income has been generated.

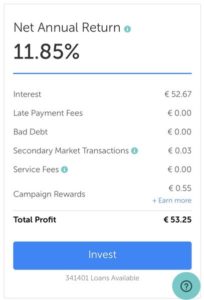

Mintos calculates a current Net Annual Return of 11.85 %. I wouldn’t be surprised to see that number coming down quite a bit. What I expect is to see around 10 % over the medium and long range.

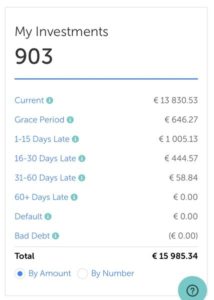

We are using the feature “Invest and Access” to put our money to work with Mintos. “Invest and Access” puts the cash automatically into loans (currently into over 900) and constantly reinvests the received interest payments and principal repayments, so the compound effect should work really nicely over the next months and years to come.

I like that feature from Mintos which only invests into credits which are (to some extent) “protected” by a Buyback Guarantee from loan generators (see also my last blogpost where I describe that mechanism).

Over the medium run, I expect these roughly 900 loan investments to generate around USD 150 in interest income each month.

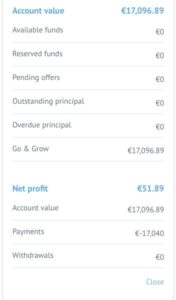

Bondora is the second platform in our P2P portfolio. Our “account” Go & Grow has been alimented with EUR 17’040 (ca. USD 18’740) in several installments over the last four weeks. That amount is a bit higher than the initially envisaged amount of USD 15’000 and we might reduce our investment in Bondora to that level by the end of the year.

So far, interest income of roughly EUR 52 (ca. USD 56) has been generated.

Bondora Go & Grow, currently with an interest yield of 6.75 % will provide us with roughly USD 100 passive income per month.

There is a lot to like about P2P investing, when using strong platforms like Mintos and Bondora, it’s pretty hands-off. It’s nice to transfer cash and almost instantly and automatically seeing passive income being generated.

And it’s also pretty cool, that from now on, Mintos und Bondora will provide us with USD 250 each month.

But the nice rewards come with a couple of risk factors (platform risks, defaults etc.) which NEVER should be underestimated or forgotten. Risks must be managed accordingly.

Diversification is key (over platforms, risk levels, loan types, duration, geography etc.) and we want to cap our P2P investments to roughly USD 60’000. That amount corresponds to around 20 % of the current market value of our stock portfolio.

We might consider taking more exposure (exceeding USD 60’000) to P2P in 2020 but first and foremost, we want to see how things work, and we will make sure that we always feel 100 % comfortable with our portfolio.

At the same time, we continue to keep a nice cash pile. Yes, it’s money earning nothing, the opportunity costs are huge, inflation is biting, but hey – “parking money” provides us with tremendous flexibility in life and let’s us take advantage of whatever attractive opportunity that will arise.

Looking ahead: strengthening our two passive income machines further

As stated in my last blogpost, my wife and I will continue to invest heavily into dividend paying stocks and SIMULTANEOUSLY putting money into P2P platforms.

Stock investments will be made from our monthly savings plus received cash dividends while we will further aliment our P2P passive income machine with “parking money” which has so far been on our savings accounts or invested in bonds.

In August, we put our passive income generation potential one step further by investing USD 4’000 into a Scottish soft drink maker.

Furthermore, we took the decision to add two more platforms to our P2P portfolio over the next weeks.

I will share with you our latest moves (stock acquisition and setting up of two more P2P platforms) in my next blogpost, so stay tuned.

How about you? Did do receive some dividends in August and/or made some stock acquisitions? Do you also invest into P2P?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

What a month MFS. Those growth percentages say it all. I don’t know what more I can say haha Just out of curiosity, do you have any concerns about the long-term safety of the BW dividend? The stock price has fallen and the company is working through some things!

Bert

Hey Bert

Thanks for your nice words, yeah, it’s really motivating to see our passive income growing at such fast pace .

With regard to Babcock, I guess we are thinking of two different companies, I might not have been specific enough in my post: I am shareholder of British defense company BABCOCK INTERNATIONAL (BAB). I have no stake in Babcock Wilcox (BW).

Babcock International (BAB) plays in a different league compared to Babcock Wilcox (BW) in terms of dividend safety and fundamentals. Babcock Wilcox (BW) seems to have some issues, indeed.

Thanks for stopping by and commenting.

Cheers

Fantastic work. Looks like a very nice month for you. Keep up the great work!

Hey BHL

Thanks for the kind words and your continued support. Yeah, we are very excited about the boost in our passive income, dividend hikes and reinvestments are so powerful and we are also looking forward to see our P2P positions contribute even more month by month.

Thanks for swinging by and commenting.

Pingback: August Dividend Income From YOU The Bloggers! - Dividend Diplomats