USD 11’000 in just nine months

Last year, when my wife and I set our 2019 passive income target, we would never have imagined that we would surpass that milestone so fast.

From January to September, we’ve collected more than USD 11’000 from three passive income sources:

- stock dividends: USD 10’000

- interests from corporate bonds: USD 600

- income from P2P platforms Mintos, Bondora, Grupeer and Twino: USD 490 (August & September)

Raising the bar higher: USD 20’000 by end of 2020

We see very good growth potential for both of our passive income machines (dividend paying stocks plus P2P investments) and want to push our goal much higher; in fact, we aim for USD 20’000 in passive income by the end of 2020!

That’s a huge jump, but we want to raise our performance to that level of our expectations. We love the “magic” wisdom behind the phrase, saying that

- it is far better to aim too high (risking to miss) than setting targets too low and hitting them (comfortably).

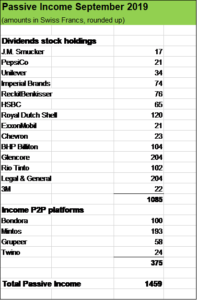

Let’s have a look at our September passive income

80 % income jump year over year

Compared to last year in September (with USD 800 dividend income), our stock portfolio got significantly stronger due to

- the addition of 3M,

- the built up of existing positions (British insurer Legal & General, tobacco company Imperial Brands and mining giant Glencore) and

- very good organic dividend growth.

These three factors pushed our dividend income for the month 50 % higher compared to September in the previous year.

And of course, there was another strong effect:

- the establishment of our peer to peer (P2P) portfolio consisting of four platforms (Bondora, Mintos, Grupeer, TWINO).

We started early in August and our P2P investments have already been churning out cash in the amount of over USD 375 in September!

For October, we can expect USD 500 which is just amazing.

P2P investments and of course our dividend paying stock holdings are key drivers for our future passive income development.

Good organic dividend growth

As long term oriented dividend growth investors, we are keen on seeing regular payout increases of our stock holdings.

And with regard to our September contributors, there were some nice hikes of shareholder distributions:

- Legal & General: + 7.2 %

- Chevron: + 6.2 %

- Exxon Mobil: + 6.1 %

- Rio Tinto: + 18.9 %

- BHP Billiton: + 23.4 %

- JM Smucker: + 3.5 %

- Unilever: + 8%

- Imperial Brands: + 10 %

- PepsiCo: + 3 %

- Reckit Benkiser: + 3.5 %

Our mining company holdings Rio Tinto and BHP Billiton showed particularily strong organic dividend, on top of that, Rio Tinto made another special distribution to shareholders. NICE!!

Its peer Glencore, oil and gas supermajor Royal Dutch Shell and bank giant HSBC held their dividends steady.

3M is a relatively new position in our portfolio, the latest dividend hike was by 6 %.

USD 380 from P2P platforms Bondora, Mintos, Grupeer and TWINO

As said, we started building our P2P platform a few weeks ago by putting roughly USD 17’450 (EUR 15’950) into Mintos and USD 18’740 (EUR 17’040) into Bondora. Then in September, we added Grupeer and TWINO to our P2P portfolio.

Currently, we have roughly USD 50’000 invested in these four P2P platforms and so far have collected roughly USD 500. That’s the cool thing about P2P, you earn money almost instantly once you have put money to work.

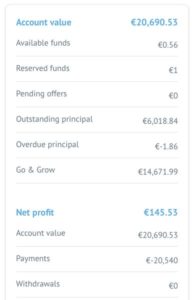

Bondora

We curently have almost EUR 20’700 (USD 22’600) invested in Estonian platform Bondora, up from roughly EUR 15’950 (USD 17’385) compared to last month.

We reduced our position in”Go and Grow” by EUR 3’000 shifting to Bondora “Portfolio Manager”. Roughly EUR 6’000 are now directly invested into loans issued by Bondora and will generate significantly higher yield than the 6.75 % we receive with “Go and Grow”.

Bondora’s product “Go and Grow” is a very liquid P2P investment, meaning that one can cash out his or her funds with minimal effort (there is just a flat withdrawal fee of EUR 1 regardless of the size of the account).

With roughly USD 14’600 in “Go and Grow”, the investment process into consumer credits kind of happens in the background.

The amount of EUR 6’000 diversified in over 2000 loans (resp. fractions of loans) issued by Bondora. I expect our yield to be in a range of 10 % to 17 %.

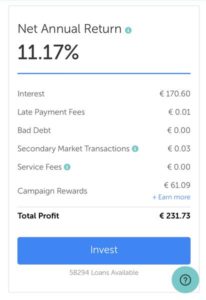

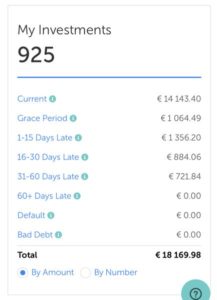

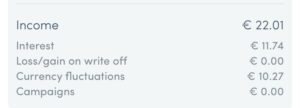

Mintos

In a matter of just a few weeks, Mintos has provided us with EUR 232 in cash. EUR 61 is a campaign reward as I registred through an affiliated link which is of course no recurring income, but I think it’s very realistic to receive interest income in a range of EUR 200 and 250 each month. In fact, I expect Mintos to become a cornerstone of our P2P Portfolio.

In September, we have added EUR 2000 to our position, bringing our loan investments on Mintos to over EUR 18’000 (USD 19’600).

Investing in loans with 11 % average yield offered with a “buyback guarantee” is pretty sweet.

Mintos, in contrast to Bondora, does not issue loans. It is a global online marketplace for loans, currently issued by over 60 loan originators. The so-called “buyback guarantee” means that if repayments of loans are delayed by 60 days, then the loan originator has to buy back the loan.

So, there is to some extent a protection of investors against defaulting loans. Personally, I prefer calling it “buyback promise from loan originators” (when it comes to investing, there cannot really be a “guarantee”).

I like Mintos very much, as it offers a huge range of different loans and the tool “Invest & Access” makes it possible to very easily build a very profitable, diversified loan portfolio whereas all positions are backed by a “buyback guarantee”.

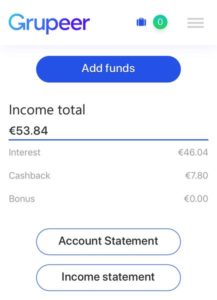

Grupeer

I have currently EUR 8’500 (ca. USD 9’300) invested in Grupeer.

Grupeer is a very straightforward platform with very interesting projects, offering yields of around 13 % whereas currently all of our loans have a “buyback guarantee”.

So, there’s a lot to like about that Estonian P2P platform.

On the other hand, Grupeer currently does not have a secondary market, so one cannot sell loan positions. I consider an investment on Grupeer as significantly less liquid as on Mintos, Bondora “Go and Grow” or TWINO.

TWINO

TWINO is a Latvian loan originator company whose investment platform was launched in 2015.

My loan investments perform smoothly with average yield of roughly 9.5 %, all backed either by a payment guarantee or a buyback buarantee.

TWINO is – like Bondora – the issuer of the loans offered on the platform.

Under the payment guarantee, TWINO ensures that investors receive loan repayments on time, even if a borrower is late with the payment.

Under the buyback guarantee, by contrast, TWINO will compensate both the invested principal amount and interest, as well as pay the accrued interest in case a borrower is late with the repayment for over 30 days.

Currently, we have EUR 3’700 (ca.USD 4’030) invested in TWINO and I think given the lower yield compared to Mintos we will increase our position to EUR 5’000 at a maximum.

In my view, TWINO is a good P2P platform, very straightforward with the possibility to invest in short term loans. TWINO offers the possibility to sell loans on the secondary market under the condition that hey are not in default.

How about you fellow Reader, how was your September passive income? Which passive income sources do you have?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

What an inspiring read. I really like your portfolio and how you’ve built a position in 3M. Some names are new for me, so you gave me some homework! 👍

Good luck!

Hi Dividendcompounder

Many thanks for the kind words!

Appreciate you stopping by and commenting.

Hi, your strategy is working. I hope you get your goal. This article is very interesting. Thanks for share.

Hi Alejandro

Many thanks! Yes, we see strong momentum with regard to our passive income strategy and are really looking forward to pushing towards our next Milestone!

Cheers

MFS – Congratulations on knocking out and achieving your goals THIS EARLY in the year. That is simply amazing. I can’t wait to see how you attack hitting $20k next year. For September, that dividend growth was amazing as well. Keep up the great work. I love 3M, so I am impartial to any blogger that is going to continue adding to that position.

Bert

Hi Bert

Yes, for my wife and me it was such a great achievement to reach USD 10’000, it took us several years to get there and now we are already attacking the USD 20’000 Milestone (by end of 2020). We would never have thought that this would be possible so fast. Organic dividend growth really helped us and of course new investments (new stock positions and our P2P Investments) gave a huge boost. We will work hard to keep on track and are so grateful to see money coming in increasing quantities through multiple passive sources.

With regarding to 3M: definitively agree with you, it’s really such a high quality company, I would not mind seeing the price come down again and add some more stocks.

Thanks, Bert, for stopping by and commenting.

Cheers

Pingback: September Dividend Income From YOU The Bloggers! - Dividend Diplomats