Shifting our financial priorities amid the Global Pandemic

It’s just amazing, how time passes fast. We are already going through the last quarter of the year which amid the COVID-19 pandemic is extremely challenging, dynamic and unusual.

The pandemic changed a lot in our societies, our economies and has huge implications for people and businesses around the world.

My wife and I remain committed our Journey towards our Big Goal of Achievieving Financial Independence by the End of 2024 by establishing and growing passive income streams which are true compounding machines and will cover 100 % of all the spendings of our family of four in a matter of just a few years.

In the short run though (with regard to the next couple of months), we have taken a much more careful investment approach than usual (compared to the years before) with a very strong focus on preserving cash, continuously working on a very robust savings rate and keeping as much as possible from our day job incomes as possible.

We have postponed larger projects such as the acquisition of rental properties in France (Haute Saône, near the Swiss border) to 2021. We had initially reserved a big chunk of our cash pile to buy several studios and one larger object in Mulhouse and Luxeuil-les Bains in France.

But the pandemic has changed a lot. For instance, it’s complicated – to some extent merely impossible – to travel and meet people and visit buildings abroad. Our investment case also changed completely amid huge business pressure, demand disruptions and uncertainties.

So, as the pandemic just “froze” or even smashed millions of projects around the world, so it did with some of our plans.

We are okay and very fortunate. We keep patient and will preserve our financial flexibility.

What we are doing meanwhile in terms of investing is setting our focus on building and strengthening our Tech Portfolio while at the same time selectively adding positions to our Dividend Stock Portfolio.

An overall strong September with USD 1’200 in cash income from investments

Let’s dive into some numbers.

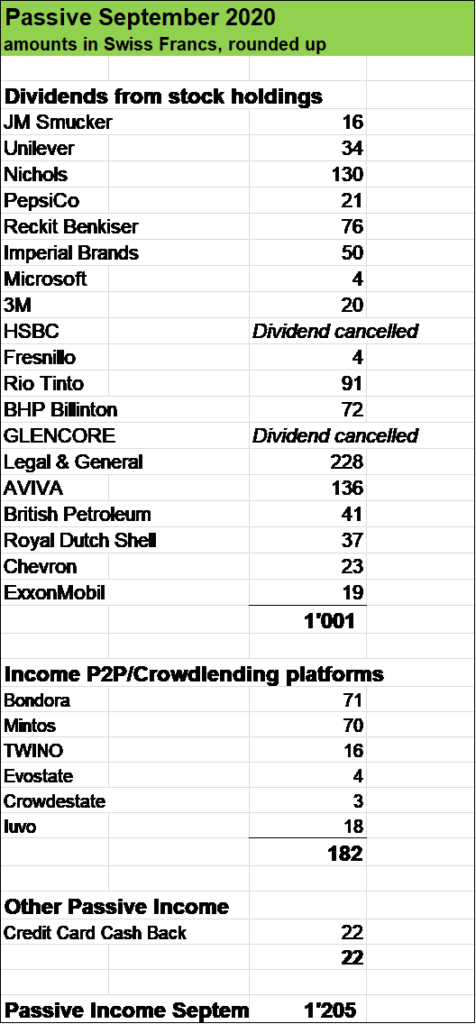

The total amount of CHF 1’205 (USD 1’325) was received in September. As you can see above, the main contributor have been dividend paying stocks with also nice inflows from Peer to Peer and Clowdlending investments.

Note: all numbers are in Swiss francs (CHF). One Swiss francs (CHF 1) corresponds to around CHF 1.10. The numbers are net after taxes (e.g. dividends are AFTER the deduction of witholding taxes etc.)!

Compared to September 2019, our total passive Income has been roughly 20 % lower (CHF 1’459 in September 2019 vs. CHF 1’205 September 2020).

While dividend income from our stock holdings (despite a few dividend cuts) was pretty the same amount as in the same month of the previous year (CHF 1’085 in September 2019 vs. CHF 1’001 in September 2020), interest income from our P2P and Crowdlending Investments was 50 % lower than in the previous year.

This was due to cash withdrawals from our P2P and CL platforms.

As I’ve shared in previous blog posts, we withdrew significant amounts from our P2P/CL platforms to become more diversified and use the funds to take stakes in growth companies by investing quite heavily into our “Mini Tech Portfolio” we started to build in April this year. We have so far invested more than USD 30’000 into fifteen Tech companies such as Amazon, Alphabet, Facebook, Shopify, Microsoft, Netflix etc..

Early in September, we bought shares of Apple for the amount of roughly CHF 2’000 (USD 2’200) and also took a stake in fitness equipment maker Peloton for around CHF 400 (USD 440).

The market value of our Tech Stocks has grown quite nicely by 30 % to well over CHF 40’000 in the last few months.

Currently, we have three kind of investments:

- First comes our dividend portolio (market value over CHF 260’000) with around 80 positions such as Nestlé, Coca Cola, PepsiCo, Altria, Unilever etc. This portfolio is set to churn out at least USD 16’000 annually in form of dividends and mainly grows through dividend reinvestments (into existing or new positions), while from time to time, we make selective additions. In September for instance, we added rougly CHF 1’500 by investing into Mc Cormick (a US food company producing spices, seasoning mixes, condiments and other flavoured products).

- Second comes our P2P/CL portfolio where around CHF 20’000 are put into following six platforms: Mintos, Bondora, TWINO and Iuvo, which all four focus on consumer loans and EvoEstate as well as Crowdestate which both letting you investing into loans in connection with real estate projects.

- Then comes our new Tech Portfolio. Our holding in growth stocks don’t pay dividends with a few exceptions like Microsoft and Apple. These fiften companies in our Tech Portfolio have each the potential to be true sector disruptors with massive growth potential. As long term oriented investors, we want to have stakes in these companies that are having a huge influence on our way of life.

What about you, fellow reader, how was your September in terms of Passive Income? Did you buy some interesting new stocks or other income producing assets?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

My Financial Shape –

Very interesting month, right? First – very cool on the tech disruptor portfolio. Hope that that plays well for you.

I did not know HSBC suspended their dividend for now – I hope that resumes for you soon.

Solid month, though, of income at 4 digits, again! Keep GOING!

-Lanny

Hi Lanny

Indeed, September and the months ahead are amazingly interesting, there is so much going on.

Our Tech Disruptor Portfolio is a pretty cool project and my wife and I will add more position step by step.

Our dividend paying stocks are doing ok, but of course that portfolio took a pretty hard hit amid the pandemic. UK Bank giant HSBC is just one example of several businesses that suspended their dividend for 2020. My guess is that regulators had a huge influence, amid uncertainties around the world, BREXT talks etc., to preserve cash and temporarily avoid/stop dividend payments and share buybacks. That said, there is some probability that HSBC will at least pay out a “mini dividend” at the back end of the year and will hopefully resume making shareholder payouts next year.

Thanks for stopping by and commenting.

Cheers

F.S.

Hi, I would like to know how long ago you started investing and what positions and stocks you started with. What do you think should be the minimum starting capital for a beginner? If it’s not difficult for you to share, I would be grateful.