Wow! Time’s really flying by, and my passive income review with cash flows from dividend paying stocks and received interests from Peer to Peer and Crowlending Platforms is more than due.

Let’s quickly get into the numbers.

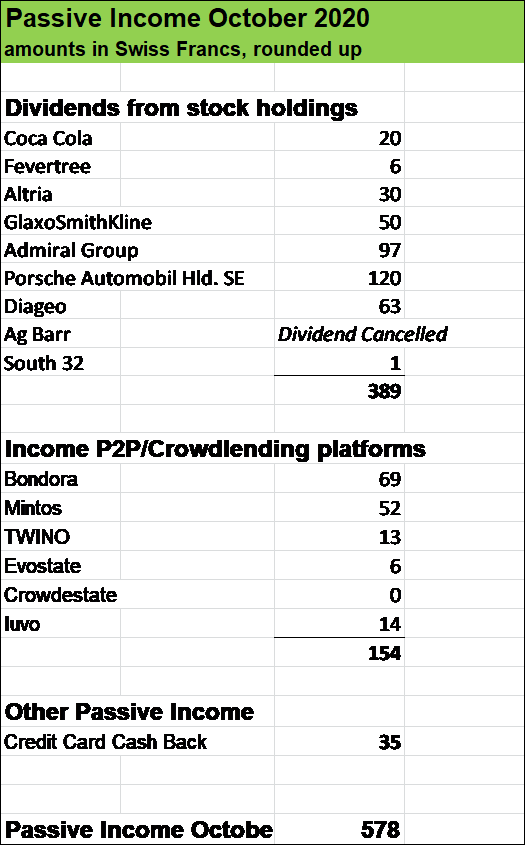

Note: all numbers are in Swiss francs (CHF). CHF 1 corresponds to around USD 1.10.

5.5 % higher dividend income but more than 70 % lower cash flows from Peer to Peer lending

While October 2019 showed total Passive Income of Swiss francs 880 (USD 968), we now see a lower total amount of roughly CHF 580 (resp. USD 640).

This was solely due to withdrawals from Peer to Peer platforms I made over the past months. Last year, we had almost USD 60’000 invested on different P2P/CL platforms. I’ve reduced these investments by almost two third. The cash withdrawals have been used to build a very nice Tech Portfolio by investing around USD 40’000. I’ll post a separate article about my four latest stock acquisitions in the Tech sector. So stay tuned.

Dividend income was slightly higher this month compared to October in the previous year (CHF 377 in October 2019 versus CHF 389).

It’s difficult to compare the different Dividend Income Updates of this year with the numbers in 2019 amid the challenges caused by the COVID-19 pandemic. I’ve seen several dividend cancellations, some cuts as well as some deferred payouts.

But it’s also interesting to see huges differences how the businesses are affected. For instance, while British tonic maker Fevertree navigates smoothly through the crisis and managed to increase its shareholder payout, Scottish soft drink producer Ag Barr sees huge challenges to remain profitable amid closures of bars etc. One would think that Fevertree would have been hit harder than Ag Barr whose drinks can be found in many Scottish households whereas Fevertree’s tonic is mostly consumed in bars which have been hugely impacted by lockdowns.

Marlboro maker Altria hiked its dividend a bit (+2.4 %) as did Coca Cola (+2.5 %).

Spirit and beer maker Diageo maintained its payout despite shutdowns of pubs and restaurants around the world have been hammering its business.

British pharma company GlaxoSmithKline maintained its payout stable compared to the previous year as did Porsche Automobil Holding SE and British car insurer Admiral Group (the company pays out a higher ordinary dividend but also lowered the special dividend compared to the previous year).

South32 is a spin-off of mining giant BHP Group and has reduced its shareholder distribution. I am fine with that, it’s a tiny position and when the world economy will recover frome the pandemic, mining companies such as GLENCORE, Rio Tinto, BHP etc. will benefit as well as cyclicals and many consumer staples that have been hit from closures of restaurants and pubs.

How was your October in terms of Passive Income?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Pingback: Dividend Income from YOU the Bloggers – October 2020

Pingback: Dividend Income from YOU the Bloggers – October 2020 - ResourceShark Blog