Hey there, fellow readers.

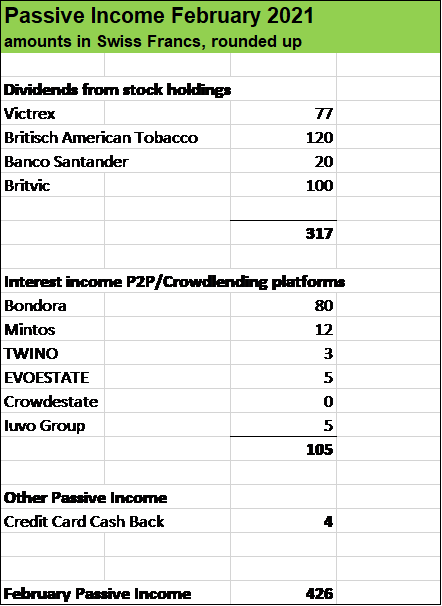

With my February Passive Income being more than overdue, I will quickly run through the numbers and share with you also our latest Stock Buys and Sale of Share Positions.

USD 426 versus a loss of USD 2’053 one year ago

Last year in February, our Passive Income was heavily negatively impacted by the collapse (scam) of two Peer to Peer/Crowdlending Platforms I had invested in (Kuetzal and Envestio).

I had to write-down the amount of USD 3’100, which in addition to several dividend cuts in 2020 amid the COVID-19 pandemic led to a Big Earning Miss in 2020. Total Passive Income has been significantly lower with under USD 10’000. Initially, my wife and I had targeted USD 20’000 in passive income for 2020.

It’s good to see, to be on track again, with a robust February Passive Income result.

We work towards total Passive Income for 2021 to be at least USD 15’000 which is roughly 50 % higher than in 2020, and 7 % on top of what our total investments generated in 2019.

Aggresive investment shift has paid of nicely

Since April 2020, my wife and I have invested heavily into Tech Companies, financed to some degree by cash withdrawals from our Peer to Peer and Crowdlending investments and underpinned by our increasing savings rate (we cut spendings amid the pandemic and shaped our cost structure).

Over the last weeks, I sold out stocks with a total market value of almost USD 15’000 and reinvested a portion of the sale proceeds (roughly USD 5’000) into new stock holdings and two new Crypto Positions.

And still, due to a Strong Performance of our Dividend Stock Portfolio and our Tech Holdings, the total Market Value of our Share Holdings easily jumped over USD 400’000 (compared to roughly USD 300’000 one year ago).

Over the last weeks, I had acquired stocks of following companies (for a total of roughly USD 5’000):

- Mc Donalds

- L’Oreal

- Pernot Ricard

- Total

- Paypal

- Adobe

- Zoom

- Nvidia

- Nio

- Sea Limited

Furthermore, I invested around USD 1’000 in Bitcoin and Ethereum.

Over the last twelve months, tech investments had shown a performance of almost 45 %, driven by positions like Facebook, Square, Tesla (see post Tesla is more than just cars), Amazon and Shopify etc.

But also our much less dynamic Dividend Stock Portfolio had a very nice run-up over the last weeks, mainly driven by positions like the Walt Disney Company, LVMH, Porsche, BMW, SIXT etc.

Cyclical stocks recovered very well, in particular oil and commodity shares (Rio Tinto, BHP Billinton, Royal Dutch Shell etc.) and chemicals such as BASF and Covestro.

Amid the very strong performance of many stock positions in our Tech and Dividend portfolios, we decided to put some money off the table and exit following holdings:

- British American Tobacco

- Imperial Brands

- Altria

- Massimo Zanetti

- 3M

- JM Smucker

Furthermore, we sold off all our shares in tech company Slack, which will be acquired by Salesforce. This move was profit-taking from our side and I am sure, that I will be able to enter into a position of Salesforce at more attractive conditions lateron.

I wrestled some time with selling 3M, which is a dividend king and a very well positioned company. On the other hand, we are already well positioned in several of its industries through Henkel, Reckit Benkiser, BASF, ABB, Victrex etc.

I exited all tobacco positions (Altria etc.) as these holdings definitively don’t fit with our investment strategy anymore.

Massimo Zanetti and JM Smuckers are classic “consumer defensive, coffee stocks”. We are already very heavily positioned in various consumer staples names such as Nestlé, Unilver, Heineken etc.and I preferred taking a stake in Mc Donalds, we also had taken a stake in the world largest chocolate producer Berry Callebaut back in 2020 as well as in Danone and drink companies like Fevertree, Campari etc..

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Leave a Reply