Hey there fellow reader, welcome to my monthly update regarding our income streams from stock- and Peer to Peer investments.

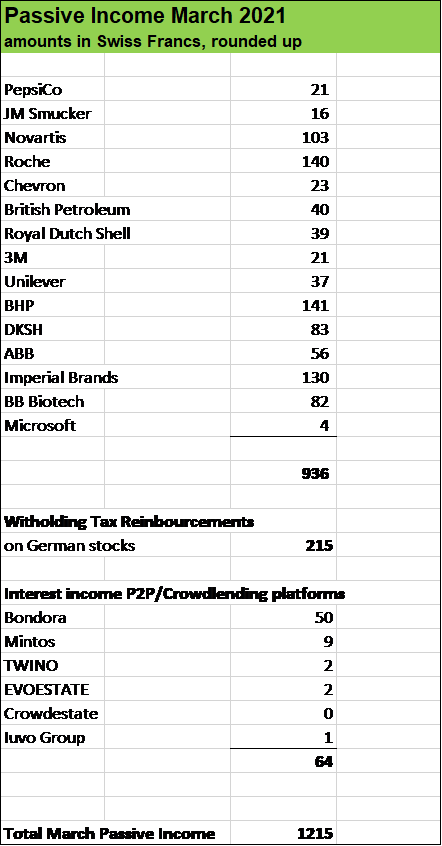

The first quarter 2021 ended quite nicely with USD 1’215 in passive income generated in March, which is 30 % higher than in that same month one year ago.

This increase was due to a combination of organic dividend growth, the contribution of new stock positions (Microsoft, BB Biotech which both were added in 2020) and witholding tax reinbursements on our German stocks (2019 dividends).

For the whole year, we target at least USD 15’000 in Passive Income (net after taxes) which looks quite achievable. Over the first three months, more than USD 2’000 have been generated, resp. more than USD 650 per month on average.

The second quarter traditionally is the strongest one, with many of our European stock holdings paying out their annual dividends.

In the last three months, my wife and I held our savings rate well above 70 % which gave a nice boost to our wealth accumulation process.

In addition Stock Performance had a positive effect: for instance holdings in Facebook and Alphabet in particular have been marching up quite nicely. Currently, the market value of our total Stock postions stands at around USD 440’000 (see our Dividend Stock Investments and our Tech Portfolio).

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Leave a Reply