Dear fellow reader, thanks for stopping by for a new update on my Crypto Portfolio which I started in February.

A brief look at our stock investment performance

First, what happened to our shareholding positions?

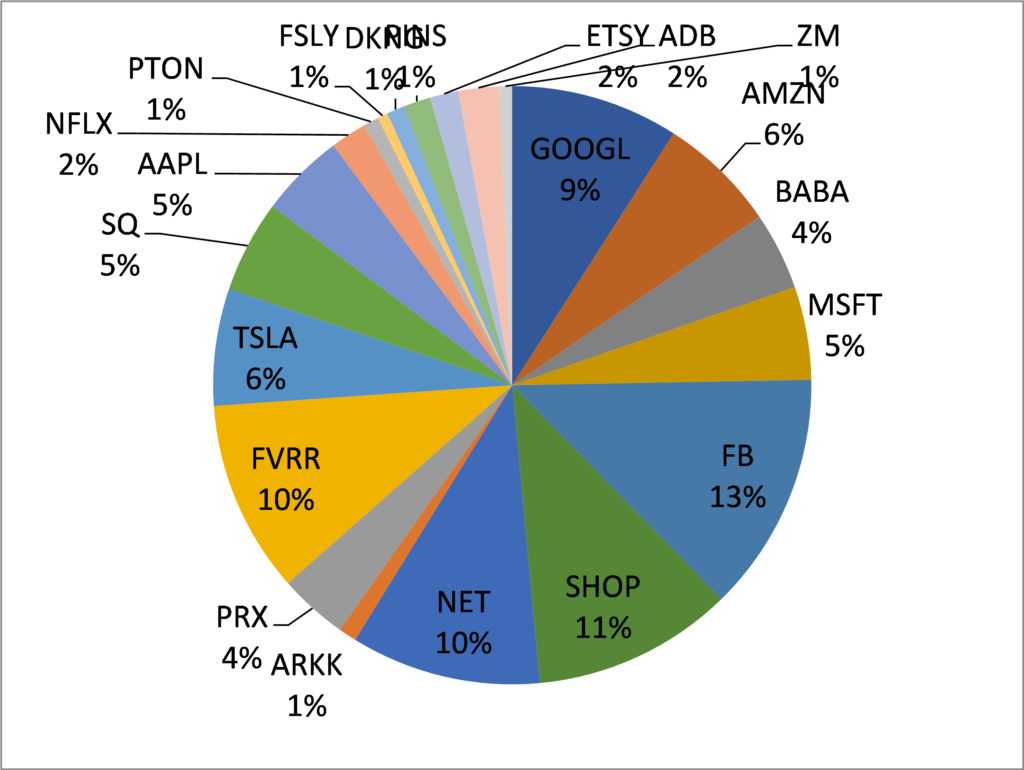

Well, global stock markets continued their bull run and in particular our Tech Stock Holdings have been pushed up quite nicely.

In particular Facebook, Shopify, Cloudflare, Amazon, Alphabet. Microsoft and Apple have been jumping from All Time High to All Time High.

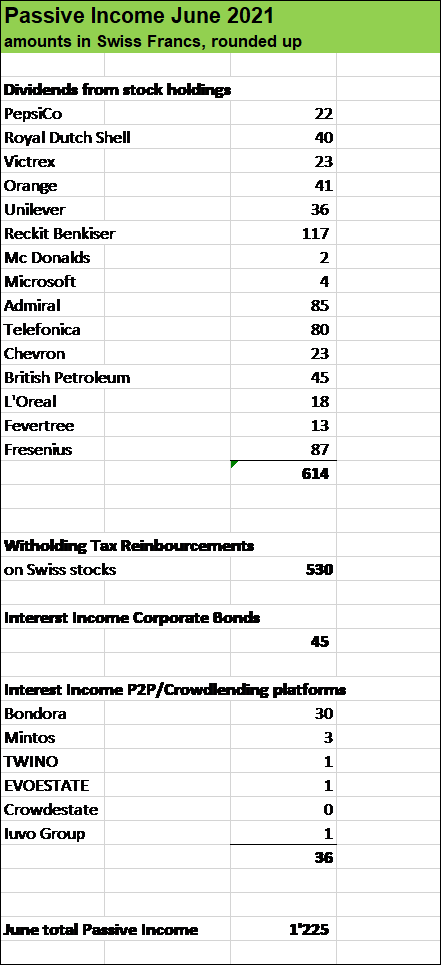

But also several positions in our Dividend Stock Portfolio had a great run in the last few weeks too. Swiss pharma giant Roche for instance has been a very strong holding position for almost a decade and has been rewarding me with an ever increasing dividend income stream and finally, it has hit All time High. But consumer staples like Nestlé and PepsiCo have been moving up strongly.

Our total stock investments with a market value of roughly USD 450’000 have moved higher by around 5 % in July alone. so a very nice boost to our wealth.

How about Cryptos in July?

The universe of Crypto Applications- and Currencies is huge.

As per July, I have invested around USD 4’000 into four positions and made no changes (no additions, no selling compared to the last crypto investment update).

- Bitcoin (BTC or XBT) is the first ever Crypto. You can find further information on the history, applications and blockchain technology, Bitcoin Mining etc. in the article WHY INVESTING IN BITCOIN.

- Ethereum (ETH) in contrast to Bitcoin can do a lot more, for instance can it be used for smart contracts and decentralized applications. See also the article BUILDING THE INVESTMENT CASE FOR ETHEREUM.

- Cardano (ADA) is a cryptocurrency network and open-source poject bult on the blockchain (see article WHY INVEST IN CARDANO).

- Ripple (XRP) sets its focus on improving international payments between financial institutions. There are currently hundreds of institutions that use XRP.

Currently, my Crypto portfolio has a market value of Swiss francs (CHF) 3’000 resp. around USD 3’300 whereas I am sitting on a book loss of roughly 23 %. or USD 700.

Currently, I am considering putting another USD 1’000 into Cryptos, equally distributed on the four current positions.

I’ll keep you updated how my new crypto investment portfolio has developed and how the positions have performed since they have been acquired.

What about you? Are you invested in Cryptos as well? Have you made any moves lately?

Thanks for sharing in the commentary section below.

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.