Welcome to our first update of the year on our passive income from our

- Dividend paying Stock Portfolio and

- Peer to Peer (P2P) and Crowdlending (CL) Portfolio.

January was a very busy month and I’m thrilled to give you also an update on our recent project plans: the build-up of a real estate portfolio generating substantial rental income. My wife and I set us a time frame of around two years, as the process has some complexity.

All right, let’s get into the numbers.

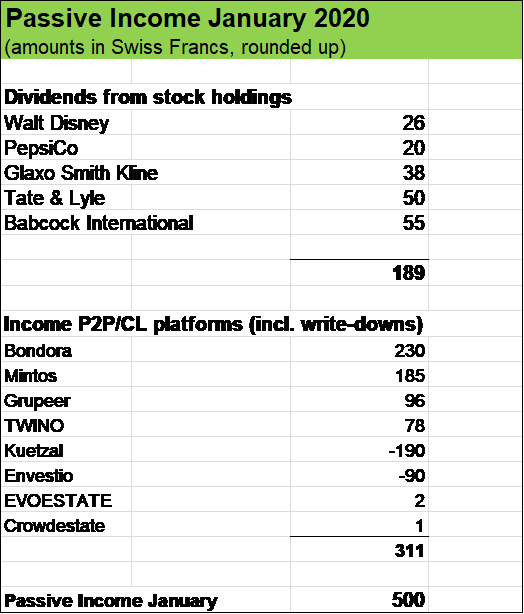

+ 68 % passive income increase compared to January 2019

Last year, we started with USD 296 in dividend income for the first month. At that time, we had five businesses paying us dividends whereas now there is additional income from our P2P/CL portfolio.

Compared to the previous year, our current January dividend income came in lower. This is due to two effects: Last year, British-Australia mining giant BHP Billiton paid out a huge special dividend and we received the amount of USD 141 in January.

In addition there is a “technical factor” with regard to Telefónica’s ditribution date: this time, Spanish Telefónica paid out its second semester dividend in December and not in January.

So, these two effects (BHP Billiton and Telefónica) made a difference of USD 212 compared to the previous year.

On the other side, there are two new January dividend contributors: Tate & Lyle (a British supplier of food and beverage ingredients to industrial markets) and UK defense contractor Babcock International which both contributed nicely in January with USD 50 and USD 55.

While there were several very positive developments in our pursuit to build up strong Passive Income Machines, we also saw severe financial setback with regard to our P2P/CL Portfolio which will adversely impact passive income generation in the next months. Two of our constituents – Kuetzal and Envestio – have collapsed and I will make monthly write-downs through the year in the amounts of USD 190 (for Kuetzal) and USD 90 (for Envestio). I will get into that issue lateron.

Overview on our January dividend contributors

Note: there is full list of all our stock holding on a separate page.

PepsiCo’s latest dividend increase was by 3 %, growth of shareholder distributions is lower than in the previous years. But slowing dividend growth is nothing to lament about. PepsiCo is a a cash machine with several growth drivers. I see PepsiCo as a diversification successs story. That business is one of the very few I see playing in the same league like Swiss food giant Nestlé, which made generations of investors a fortune.

Disney recently announced to hold its dividend steady which makes perfect sense to me. Yes, Disney generates somewehere in the Region of USD 10 Bn. in free cash flow annually, but after the USD 70 Bn. acquisition of 21st Century Fox and huge ongoing projects like the global roll-out of the streaming service Disney +, the focus obviously will be set on consolidation, integration and debt reduction. Disney has been an amazing investment over the last five years and we will continue to hold the shares for decades. It’s interesting to read my thoughts on Disney back in October 2016, a few days before I had initiated my position. At that time, the stock seemed completely out of favour in the investor community. Interesting, how its perception can change in a matter of just a few years.

Let’s move on to the next January dividend contributor.

British Pharma Giant GlaxoSmithKline has held its payout steady for several years now, but with a yield on cost of roughly 6 % and the possibility to participate in the company’s dividend reinvestment plan (DRIP), I am fine with that. GlaxoSmithKline is one of my favorite positions in that sector (next to Swiss Giants Roche and Novartis, which I have been holding for roughly a decade now). What I like about GlaxoSmithKline is its diversification, with uniquely strong brands (Odol, Dr. Best, Sensodyne, Voltaren etc.). GlaxoSmithKline and Pfizer plan to combine their consumer health businesses and distribute shares of a newly formed company to the shareholders (2/3 GlaxoSmithKline and 1/3 Pfizer) which could be very interesting. But even without the spin-off, there is plenty of opportunities to create further shareholder value.

Tate & Lyle specialises in turning raw materials such as corn and tapioca into ingredients that add taste, texture, and nutrients to food and beverages. It Counts businesses like Unilever and PepsiCo to its customers. I particularily like the sound financials of Tate & Lyle while providing us with an attrictive yield on cost of 4 %. The latest dividend increase of Tate & Lyle was by 2.3 %.

Babcock International provides highly-specialised engineering support services on complex and sensitive equipment and infrastructure, including assets owned by the British Ministry of Defence which include military and naval bases, submarines and jets. Babcock Interational operates in areas with high barriers to entry, protecting its robust margins and strong free cash flow generation. Our yield on cost is almost 6 % and the latest dividend hike was by 1.3 %.

P2P/CL Portfolio income generation adversely affected

Our two flagships Mintos (USD 185) and Bondora (USD 230) generated robust interest income in January, the same with Grupeer (USD 96) and TWINO (USD 78). Unfortunately we saw a massive financial blow due to the collapse of Kuetzal and Envestio. I decided to write off 100 % of these positions evenly through the next twelve months (USD 190 for Kuetzal and USD 90 for Envestio on a monthly basis).

In December 2019, serious doubts on projects on Kuetzal and on the platform have arisen from investors which led to a “bank run”. Kuetzal had initially promised to take back loans against a charge of 10 % but very obviously had not the liquidity required. Envestio which has the same business model collapsed a few weeks later and even shut down the homepage. My impression is now that both platforms have been scams. Police investigations on Kuetzal and Envestio are under way or just a matter of time.

There is little chance that investments on Kuetzal and Envestio can be recovered. On 10 January, I had given the order to Kuetzal to transfer my cash in the amount of EUR 470 to my bank account which was confirmed by Kuetzal. But til now I have not received anything.

I got in touch with my legal assistance insurance which will support me with the amount of several hundreds Swiss Francs. The investment damage is not directly covered in their view but at least they are prepared to pay me a certain amount, so to say as a gesture of goodwill for a long-time customer.

Nevertheless, the whole Kuetzal and Envestio issue is disappointing and with regard to our P2P/CL portfolio, I will make a substantial risk re-assessment. Here are my first actions I have already taken:

- Winding down position in Fastinvest (EUR 500 had been invested)

- Reduction of TWINO position by EUR 500

- Reduction of position Bondora Go & Grow by EUR 3’000

- Reduction of position in Mintos by EUR 200

- Reduction of position in EVOESTATE by EUR 450

I trimmed our P2P/CL investments by EUR 4’500 (roughly USD 5’000) and considering the collapse of Kuetzal and Envestio, our portfolio decreased from USD 67’000 by 13.5 % to USD 58’000, bringing our exposure down from 8 % (as of 31.12.2019) to around 6.4 % of our total wealth.

Mintos and Bondora have been our two flagships from the beginning on and should continue so.

Grupeer performed well so far. Nevertheless, I decided to cut back that position quite a bit over the next months and use that cash to build a new P2P position. I have my eye on some interesting platforms but will take my time to make up my mind. After the Kuetzal and Envestio debacle, I want to be significantly more careful.

All Right, let’s turn to our real estate project

My wife and I will travel to France in April to visit several appartments in Mulhouse which is located a few kilometers from the Swiss border (Basel). Mulhouse is an interesting city I have known since my childhood. What I like are the moderate real estate price levels and the vast offer. We want to buy several appartments and rent them out, mainly to students. We have family members in France which could help us with our project but we decided to work with an acency – at least at the beginning.

My wife and I are working towards Financial Independence by the end of 2024 and – currently living in Central Europe with our two children – are considering to build a second mainstay in France. That’s why we also have our eyes on residential properties. There are plenty of very nice houses with beautiful gardens.

I’ll keep you updated.

Thanks for reading.

What about you, fellow Reader, how was your January in terms of passive income?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Thanks for your very comprehensive update.

It’s really exciting to see your progress towards financial independence.

What is also interesting, is how you take action after setbacks just like the ones your recently experienced with Kuetzal and Envestio.

Fingers crossed that your other P2P investments will find a better ending.

All that being said, I enjoyed your article very much and look forward to your further development in 2020.

Best wishes from Hamburg

– David

Hi David

Thank you for your kind words!

Yes, our journey towards Financial Independence is extremely exciting for us, we enjoy the path and are looking forward to our “new life” once we have achieved our Big Goal in 2024.

Oh yeah, fingers crossed that we’ll not see the collapse of two crowdlending in one month again. I’m very confident, that our P2P portfolio will have absorbed the loss and return to growth in a few months. I’m doing a complete risk-reassessement to bring more quality and stability to our P2P portfolio.

Appreciate your comments, and thanks for stopping by.

Cheers

Hello,

I just discovered the blog while looking for other investors from Luxembourg and I find it very helpful.

I’m looking to start investing myself and I’d appreciate it if you could talk about what broker you use and what taxes you pay on the different stocks you own depending on the country.

Thank you!

Hi Adi

Of course, I’ll be happy to share in my next blogpost some information about the broker I use (currently Swissquote) and the (witholding-) taxes I have to pay on dividends on stocks from different countries (depending on the existence of a double taxation treaty). I appreciate your interest.

Please know, that I am not from Luxembourg but from Liechtenstein and Switzerland.

Glad you stumbled upon my blog and thanks for stopping by.

Cheers

Pingback: January Dividend Income from YOU the Bloggers! - Dividend Diplomats

There’s nothing like earning money without doing much work for it. Getting that stimulus check was good. Congrats on the strong passive income numbers for January.