USD 14’000 passive income in 2019 and more to come

(Note: the majority of our investments are denominated in Swiss Francs (CHF), which trades more or less at parity to the USD. For simplicity, I give the numbers in USD).

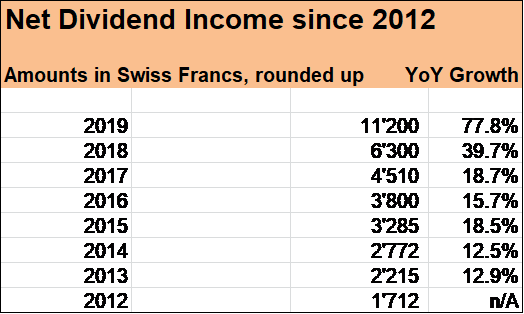

At the beginning of 2019, my wife and I set the target to achieve at least USD 10’000 in cash returns from our income generating assets (such as dividend paying stocks, corparate bonds).

That Passive Income Goal for 2019 was then SMASHED already in September! Hitting our target so fast gave us more confidence and we set the bar higher for 2020, pushing our Passive Income Goal to USD 20’000.

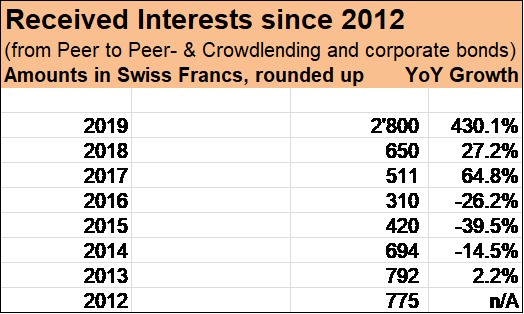

Our decision to set up a Peer to Peer (P2P) and Crowdlending (CL) Portfolio was a real gamechanger. Not only could we diversify our wealth further and optimise our asset allocation, it also gave our Passive Income a huge boost.

We are very confident to achieve USD 20’000 by the end of 2020, especially as my wife and I have decided to set up a Third Passive Income Machine: real estate properties which will provide us with rental income.

We set our Big Goal to Achieve Financial Independence by 31.12.2024 and acquiring income generating assets really is paramount.

But the savings rate really stands at the center when it comes to one’s financial shape and it really is the basis for our investment process. Over the years, my wife and I managed to boost our savings rate to well above 60 % (2016: 57.5 %; 2017: 66 %; 2018: 53 %; 2019: 65 %) despite reducing our work pensa. These savings rate are “magic numbers” for as, as everything above 60 % is a REAL TURBO TOWARD FINANCIAL INDEPENDENCE!

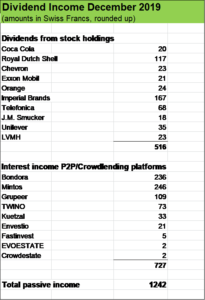

A brief look at December dividend and interest income

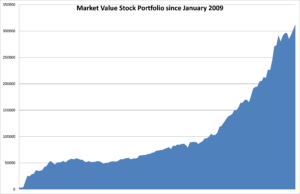

The final month in 2019 was really amazing, we not only saw a huge passive income boost from USD 413 compared to December 2018 to now over USD 1’240, but the Global Stock Bull Market gave our share portfolio a great push well above USD 310’000.

My wife and I started our journey as Dividend Growth Investors back in 2009 and it had taken several years to bring our Investment portfolio above USD 100’000, but all of a sudden, it crossed the USD 200’000 and USD 300’000 in a relatively short time period.

Our stock portfolio consists of more than 60 positions with a very strong focus on consumer staple businesses such as Nestlé, Unilever, Coca Cola, PepsiCo, Heineken, Anheuser Busch, Diageo, Britvic, Nichols, AG Barr etc. These are the kind of companies we like, just holding them for the very Long haul and collecting the growing dividends.

In December 2019, 10 of our holding positions churned out over USD 500 in cash, compared to slightly above USD 400 the same month one year ago.

That growth of roughly 20 % was due to a combination of following factors:

- change in dividend payout from Spanish Telco Company Telefonica

- topping up position in tobacco company Imperial Brands

- dividend reinvestments and

- organic dividend growth (hikes ot payouts to shareholders).

The last factor really is paramount for us Dividend Growth Investors. We want to see our stock positions to increase their payouts in a range of 5 to 8 % each year (on average).

Following December dividend contributors hiked their dividends compared to the previous year:

- Coca Cola: + 2.6 %

- JM Smucker: + 3.5 %

- LVMH: + 15 %

- Imperial Brands: + 10 %

- Unilever: + 5 %

- Exxon Mobil: + 6.1 %

- Chevron: + 6.2 %

- Orange: + 5 %

While our dividend paying stock portfolio has been firing from all cylinders in 2019, our P2P/CL Portfolio made equally good progress.

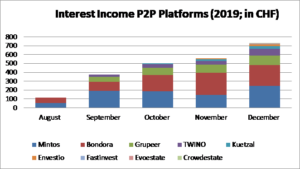

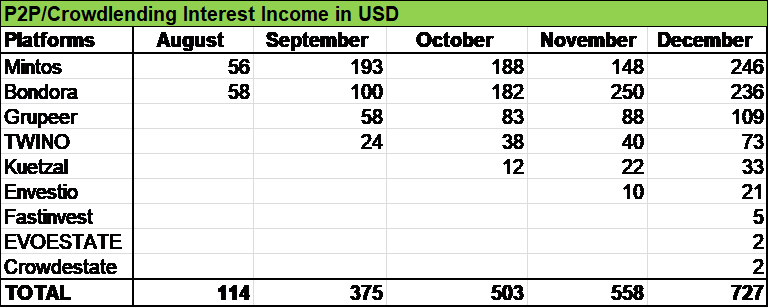

Our P2P/CL Portfolio now generates over USD 700 per month

Currently, we have USD 67’000 invested into nine different P2P and CL platforms.

Our two “flagships” Mintos and Bondora had a very strong run in December, as well as Grupeer and TWINO.

Crowdlending platforms Kuetzal and Envestio showed an increase in interest income compared to the previous month as well.

In the blogger community very serious concerns have been raised about some of the projects of Kuetzal and about the platform itself. The company has so far not given a convincing response to these concerns and criticism and I decided to reduce my exposure to that platform.

EVOESTATE, Crowdestate and Fastinvest are new additions (opened late in November).

See an overview on our nine P2P/CL platforms with print screens etc. here.

What about you, fellow Reader, how was your 2019 in terms of passive income? Which goals did you set for the New Year?

Thanks for reading my post and for sharing your thoughts.

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Congratulations on your 2019 passive income stream, it’s a great feeling to set a goal then exceed that!

I, like you, am really trying to focus on cash-generating assets such as dividends and crowdlending companies. It’s amazing to see how quickly the dividends grow over time. One of my companies is already paying out a dividend of over 15% from when I purchased the stock.

You should easily break through that 20,000!

Matt / thewahman

Hi Matt

Indeed, dividend growth investing is so amazingly effective. I have not yet a stock holding, where I can already see such a high yield on cost like you (15 %), but I am sure, just a few years down the road, and there will be several positions with double digit yield on cost. Factor in the effect of dividend reinvestments and we are truly experiencing the magic of the compound effect.

Yes, I think it should be really feasible for us to hit the USD 20’000 milestone. It’s just awesome to see bigger leaps year by year.

Appreciate you stopping by and commenting.

Cheers

wow shape just incredible growth this year. Those growth rates are huge and that savings rate, well is insane! 65% wtf…..

That snowball will grow fast for sure.

keep it up

cheers

Thanks for the motivating words. Yes, one year ago, I’d never have thought that’s even POSSIBLE to hit such numbers. There is this huge momentum and my wife and I will certainly work hard to Keep on track.

Appreciate you swinging by and commenting.

Cheers

Pingback: December Dividend Income from YOU the Bloggers! - Dividend Diplomats