Hey there, fellow reader. I am glad you’re stopping by.

As the world is going through an extremely turbulent and tough period due to the Coronavirus, take care of yourself and your loved-ones. Let’s all stand together to face the challenges and let’s remain optimistic, that better days are ahead.

Re-Focusing our Financial Targets

It’s just amazing, it took only a few weeks to smash a bull stock market that had been running for over a decade and the fight against the Coronavirus brought the world economy on the brink of a severe recession.

March has been an extremely turbulent month, the worldwide lock-down and its economic consequences also impacted our personal lives, financial decisions and our projects. Just to name some of them:

- My wife and I pushed back our trip to France to the beginning of next year (!). We had initially planned to acquire appartments in France near the Swiss boarder and renting them out, establishing an additional Passive Income Machine (diversifying our income streams from our stock portfolio and Peer to Peer (P2P) investments).

- The stock bull market came to an abrupt end in March and crashed with an amazing speed. I heavily accumulated shares over the last weeks and we will continue investing over the next months which requires substantial liquidity.

- While heavily investing into stocks and planning to acquire real estate, we want to increase our cash pile – currently in the amount of USD 500’000 – by 10 %. What we want is to go with a lot of “firepower” through these turbulent times which ALWAYS show great opportunities.

- So, early in March I took the decision to substantially scale back our Peer to Peer and Crowdlending Investments and withdrew almost USD 20’000.

- Continuously investing is important for us, but when it comes to achieving Financial Independence, the savings rate is absolutely paramout. My wife and I luckily have stable active incomes and always want to “extract” as much in form of savings. And here we had been able to make great progress. Our savings rate climbed from 68 % in January to 69 % in February and litterally jumped to over 75 % in March as we were able to reduce several cost positions.

- We still aim for USD 20’000 in total passive income for 2020, but currently set our focus on increasing our savings rate and building our cash pile further.

Working on our cost structure

The savings rate shows the percentage of one’s income (take-home pay, dividends, received interests etc.) which can be “extracted” as savings. Over the last ten years, my wife’s and my active income has been more or less unchanged. Whenever we go a pay rise, we “used” that to reduce our work pensa to have more time with our children. So, in our case, the real driver in boosting our savings rate was reducing our spending positions.

We continously assess ways to

- to become more profitable,

- boost our earnings power,

- gain more financial muscles and

- become more and more flexible and build wealth

It’s a kind of virtuous cycle.

If you want to shape your finances, you must track your spendings (rent, costs for groceries, commuting, insurances etc.) and calculate, what you keep each month! Write your savings rate down and then work on increasing it.

Tackle first the low “hanging fruits”, expense positions you can easily reduce without even feeling any disadvantage. And then immediately tackle your fixed cost block (rent, insurances etc.). Once reduced, it’s like an annuity, paying you back each year.

Our lock-down has made several things much more complicated and I hope that it will end soon, but in terms of cost structure, there are several positive effects such as

- less/no commuting to work

- significantly lower costs as almost all of our trips and holidays for the year had to be cancelled (resp. put back)

- currently no child-care costs

- no spendings for eating outside

- etc.

With a savings rate well above 70 %, cash generation and our ability to invest in income producing assets on a regular basis is strong. We want to keep – to some extent – some of these cost advantages even when the lock-down comes to an end (e.g. are we considering to become car-free etc.).

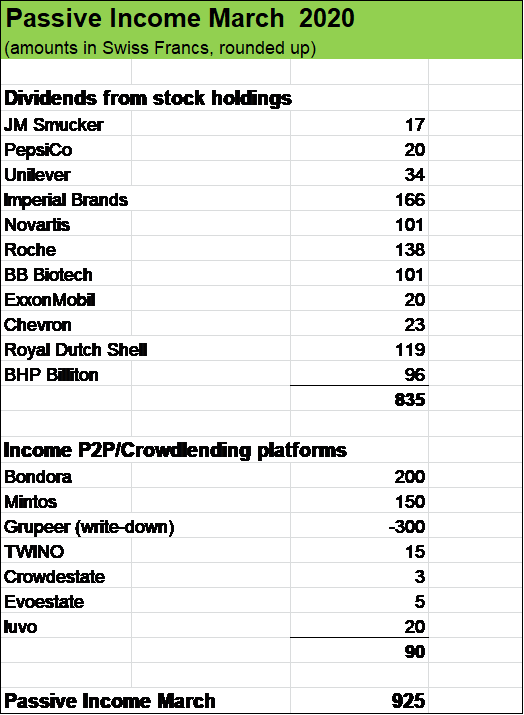

All right, let’s have a look at our passive income generated from our stock portfolio and our second Passive Income Machine – our P2P Portfolio.

50 % Passive Income jump year to date

March was a very strong month with over USD 900 in dividend and interest income, compared to over USD 600 in the same month of the previous year.

This increase was mainly due to a combination of following factors:

- We established a P2P/CL portfolio in August 2019, which is now generating interest income. This month’s P2P income was lower than the monthly expected average amount of USD 700, I will highlight the reasons lateron.

- In March we acquired a nice position in the Swiss company BB Biotech, which is a new dividend contributor for that month.

- Last year, we received the second quarterley dividend payment from British tobacco company Imperial Brands early in April, while this time the inflow happened late in March.

- March dividend contributors increased their payouts by over 6 % on average, which more than offset quite significant currency headwinds (against the Swiss francs).

Robust Organic dividend growth

Nine of our ten march dividend contributors hiked their shareholder distributions compared to the previous year.

- J.M. Smucker + 3.5 %

- Novartis + 4 %

- ExxonMobil + 6.1 %

- Chevron + 8.4 %

- Roche + 3.44 %

- Unilever + 7 %

- BB Biotech + 11.47 %

- BHP Billinton + 18 %

- Imperial Brands + 10 %

Oil and gas supermajor Royal Dutch Shell kept its payout steady.

Lower income from our P2P/CL portfolio

While interest income from our Second Passive Income machine was USD 700 in February, revenues from our P2P/CL portfolio came in substantially lower in March with “only” USD 90 which was mainly due to the write-down in our Grupeer position which I have almost completely wound down in February and March.

I reduced our whole P2P/CL positions by almost 20’000 and had stopped all automatic reinvestment programs late in February (in the case of Grupeer, I had stopped all reinvestments since August 2019).

The main reason behind scaling back our P2P/CL-portfolio is to raise our cash pile from currently USD 500’000 to USD 550’000 over the next months in order to make significant investments in the stock market and have a “war chest” to acquire real estate objects.

Late in February and early in March, I wound down our positions in Grupeer and TWINO by almost 100 % . Unfortunately, USD 300 could not be withdrawn from Grupeer, as the company announced on 25 March that they had to stop all payouts. They blamed the Coronavirus for their “temporary” difficulties. Anyway, I wrote down the remaining amount I was not able to withdraw.

Currently, we have around USD 45’000 (down from USD 68’000 by the end of 2019) invested on six platforms (Mintos, Bondora, Iuvo, TWINO, Evoestate, Crowdestate), down from nine positions by 31.12.2019.

All Right, let’s have a look, how we used the cash withdrawals to strengthen our First Passive Income Machine – our Stock Portfolio.

March was an excellent month to acquire pieces of fine businesses

I have been quite aggressively buying stocks in the last two weeks of March, putting the total amount of roughly USD 16’000 to work. Here’s our “buying list”:

- Danone (ca. USD 2’000; topping up existing position initiated in February 2020)

- Swisslife (ca. USD 4’000, bought in two tranches; new positon)

- BB Biotech (ca. USD 2’000; new position)

- Admiral Insurance Group (ca. USD 2’000 ; new position)

- Allianz Insurance Group (ca. 2’000; new position)

- Swiss Re (ca. USD 2’000; topping up existing postion initated some years ago)

- Dufry (ca. USD 2’000; topping up existing position initiated in 2019)

These additions to our stock portfolio will boost our forward dividend income for the year by almost USD 1’300, putting our full year passive income goal of USD 20’000 already in full sight!

Looking ahead

We will continue to buy stocks over the next months but presumably at a slower pace. Given the fact that share prices look quite attractive, we want to invest USD 5’000 to 10’000 each month. We’ll work very hard and save our active incomes vigourously in order to fuel our investment process.

In Addition, as said, we want to increase our cash pile from USD 500’000 to at least 550’000 over the next months to be fully in the position to take advantage of market opportunities, in particular with regard to real estates.

What about you, fellow reader, did resp. do you take advantage of recent market volatility and acquired some stocks?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Leave a Reply