Managing our Finances amid the COVID-19 pandemic

Hey there, fellow reader, welcome to my monthly financial update where I share our progress on our Journey towards Financial Independence by

- shaping our finances to boost our savings rate and

- keeping investing in income generating assets like dividend growth stocks etc.

While in the past few years my wife and I had a very strong focus on acquiring productive assets that generate Passive Income, the COVID-19 pandemic with its health risks and its enormously negative impact on our societies and global economy had us Change our Financial Priorties.

For the next months,

- boosting and keeping our savings rate above 70 % and

- increasing our Cash Pile to well over USD 550’000 (+ 10 % compared to 31.12.2019)

shall be our Key Performance Indicators.

We want to go through this crisis in a much stronger shape and as financially flexible as possible. There are a lot of uncertainties and we want to keep our ability to continue our investment process. As Dividend Growth Investors with a very strong Buy and Hold Approach, these are extremely challenging but also quite interesting times. It is true, international stock markets – in particular US-Indices like the Dow Jones Average, NASDAQ and Standard & Poors – don’t really seem to price in a very deep global recession.

But make no mistake, there are hundreds – if not thousands – of fine businesses whose stock prices are being hammered and which will eventually recover over the next 12 to 24 months. Some of them even significantly stronger than before.

There are plenty of very nice opportunities and as we are tipping our toes into real estate investing, LIQUIDITY is KEY! Having a cash pile let’s long term oriented investors take advantage of market dynamics. That’s why we decided to raise our cash pile from USD 500’000 by 10 % to USD 550’000 WHILE AT THE SAME TIME keeping investing quite heavily into dividend paying stocks and having our eyes on acquiring real estate objects if prices make sense for us.

In April, we have been quite busy and acquired two New Stock Positions (see lateron in this post) while further reducing our Peer to Peer (P2P) and Crowdlending (CL) investments which in combination with our strong Savings Rate led to a Nice Increase of the Cash Pile.

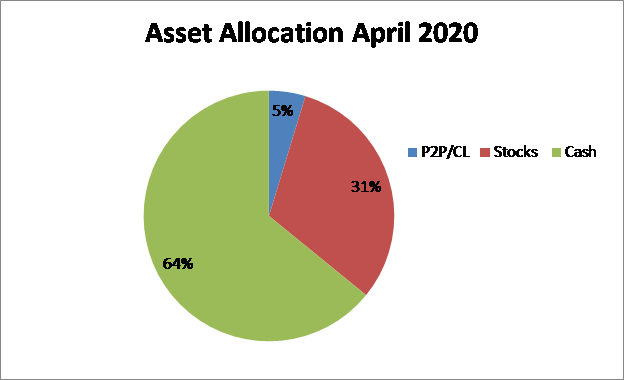

Our asset allocation as of April 2020

Compared to the end of 2019, the pie chart showing our wealth allocation changed quite a bit over the last four months:

Our investments on Peer to Peer (P2P) and Crowdlending (CL) platforms have moved from USD 68’000 to under USD 40’000 as I withdrew almost USD 30’000 over the last weeks. We currently have investments on six platforms (Mintos, Bondora, Iuvo, TWINO, Evoestate and Crowdestate) after having exited Fastinvest in February and Grupeer in March (I have written down USD 300).

Liquidity on bank accounts (Cash Pile) grew from USD 500’000 by 31 December 2019 to currently over USD 540’000. The goal ist to build that cash pile further to at least USD 550’000 by the end of June 2020. I am more than ever ambitious to build a real estate portfolio, but given the uncertainties caused by the COVID-19 crisis we will definitively approach that goal carefully and with a massive “war chest”. We have ZERO DEBT and want to keep as financially flexible as possible.

By the end of 2019, our share portfolio with over 60 dividend paying stock positions had a market value of over USD 310’000, compared to currently USD 265’000. Over the last four months, we invested around USD 25’000 into stocks, so despite financial markets having come up from their March lows quite nicely, the fall of our stock portfolio is quite significant.

Total wealth is down from 880’000 to 850’000, a drop of 3,5 % compared to 31.12.2019.

Four months of strong savings and still total assets are USD 30’000 lower than by the end of last year.

It’s never nice to see wealth decreasing. We want to grow, our assets to climb. But don’t let’s forget, that tough and volatile markets ALWAYS show tremendous opprtunities.

78 % Savings Rate in April

After almost eight weeks in lock-down, several countries in Europe (Austria, Switzerland, Liechtenstein, Germany etc.) have slowly started to open their economies which have been severely hit.

Our consumption plummeted. Our discretionary spending in particular have fallen drastically in our household which resulted in quite high monthly savings rates (73 % in March and 78 % in April).

My wife and I luckily have job positions that are quite stable – or at least hopefully continue to be so. The COVID-19 crisis is a cruel reminder that nothing is certain. So, what we want is to “extract” as much savings from our salaries, grow our cash pile and keep investing.

As said, due to lock-down, our discretionary spendings in April have gone to almost zero. No eating out in restaurants, no meeting friends in bars after work, no short travels, no vacation etc.

As hairsalons have been closed through April, my wife cut my and our son’s hair. Our ears are still intact and we look good 🙂 So, again, there were plenty factors that gave the opportunity to save a nice amount of money.

Our grocery shopping bills in April declined as well compared to the ones before the lock-down. I guess because of the tendency to buy in bulks. I chose to make one big purchase each two weeks (not only for my family of four, but also for our parents etc.) to reduce health risks. This turned out to be extremely beneficial.

One of the advantages of lock-down is to have much more time for my family. We take our time to cook together and go for a walk etc. The really important things like spending time with our loved-ones don’t cost any money.

Costs of commuting (gasoline) have almost been non-existent due to the possibility of home-office. I drove significantly less frequently to my office.

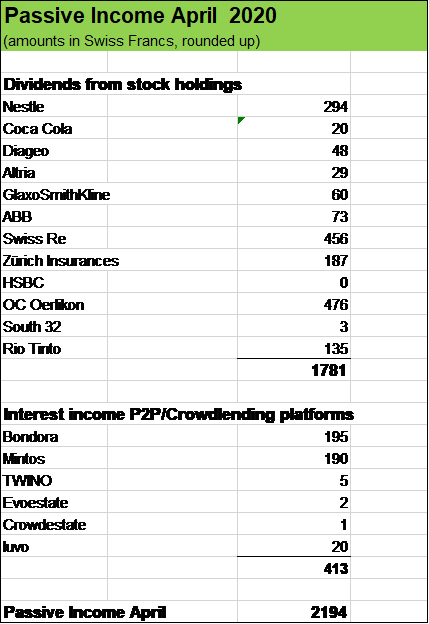

April Passive Income down 12 % Year over Year (YoY)

Compared to the same month in the previous year, there clearly were some headwinds and some tailwinds, leading to quite a mixed passive income picture.

April 2019 showed USD 2’500 in Passive Income compared to now less than USD 2’200!

Considering the circumstances we are all in, I see it positive, that our investment portfolio generated USD 2’200 in dividend and interest income (net after taxes), supporting our savings rate. But of course, what we want to see is consistent growth of productivity for our Passive Income Machines.

Let’s first have a look at the positive factors (which increased our April passive income by almost USD 500 YoY):

- Compared to April 2019, we now have P2P/CL investments, which contributed a solid amount of more than USD 410 (see how we initiated our P2P/CL portfolio in August 2019)

- In February 2020, I’ve added tobacco giant Altria to our stock portfolio which contributed USD 29 in April in form of a quarterly dividend

- Seven of our April dividend contributor have hiked their shareholder distributions compared to the last year (see the specific increases lateron) which in combination with dividend reinvestments led to a nice passive income boost.

Unfortunately, the above described positive factors have more than been offset by following headwinds (wich decreased our April passive income by more than USD 1’000 YoY):

- Bank giant HSBS scrapped its quarterly dividends from the second quarter onwards which lowered our April passive income by around USD 100.

- Because of the COVID-19 pandemic, shareholder assemblies of Deutsche Telekom, LVMH DKSH, Covestro and Henkel have been postponed. I expect the dividend amounts to be paid out late in summer or autumn (USD 198 from Deutsche Telekom, USD 266 from Covestro, USD 40 from LVMH, USD 100 from DKSH and USD 55 from Henkel). So these “technical factors” (change of dividend payment dates) reduced our April passive income by USD 620.

- Swiss industrial company OC Oerlikon made aother special dividend in addition to its regular shareholder payout but unlike in the previous year, there was no payout made from the capital reserves, which is tax free, leading to a lower net (after taxes) dividend income (USD 476 compared to USD 554 in April 2019).

- Last year, mining giant Rio Tinto made a special dividend payment in addition to its regular semester distribution (USD 247). This year, given the cirumstances there are of course no special dividends to be expected and consequently our income from that fine business has been lower in the amount of USD 112.

- Last year, we received the dividend from British tobacco firm Imperial Brands in April whereas in 2020 we got the payment in March. So that “technical factor” (change of dividend payment date) lowered our April passive income by USD 147.

So, given these combined factors, we are still quite happy with our April Passive Income Results. 2020 will certainly be a bumpy road, with many surprises and of course dividend cuts. For the year however, I still remain optimistic to achieve our target of USD 20’000 in Passive Income.

A very mixed organic dividend growth picture

As a dividend growth investor, I want to see our stock holdings generate steadily increasing payouts over time.

Seven of our April dividend income contributors did exactly that and hiked their payouts quite nicely:

- Nestlé: + 10.2 %

- Coca Cola: + 2.5 %

- Diageo: + 5 %

- Altria: + 5 %

- Swiss Re: + 5 %

- Zurich Insurance: + 5 %

- Rio Tinto: + 10 %

British pharmaceutical company GlaxoSmithKline held its shareholder payout unchanced.

As said, bank giant HSBC scrapped its quarterly dividend payments for 2020 and with regards to the companies whose shareholder meeting had been postponed I know from Deutsche Telekom and French luxury business LVMH that there will be cuts of the payouts.

Again, 2020 is gonna be tough. So, let’s fasten our seat-belts, keeping reinvesting all the dividends and of course continue putting money to work by acquiring income generating assets.

Our stock buys in April 2020

In April, I made quite a new move by acquiring for the very first time stocks of businesses that don’t pay any dividends!

Right, I put USD 4’400 to “work” without increasing our Passive Income Generation. But make no mistake, acquiring pieces of high quality businesses that are true compounding machines at a reasonable price will give a nice boost to our wealth building process.

All right, let’s have a look at our two April stock investments in the amount of rougly USD 2’200 each.

Taking a stake in Warren Buffet Company Berkshire Hattaway

Every Dividend Growth Investor knows that giant Holding Company in Nebraska called Berkshire Hattaway.

For instance, the company wholly owns auto insurance company GEICO, the battery business Duracell, the American chain of ice cream and fast-food restaurants Dairy Queen and the US railway company Burlington Northern Santa Fe.

But in my view even as interestingly, Berkshire Hattaway has significant stakes in KraftHeinz (we all know Heinz Ketchup, right?), Visa, Mastercard, Goldman Sachs and of course my favorite positions Coca Cola and i-phone producer Apple.

Berkshire Hattaway is a huge portfolio with investments in businesses I’ve been interested in for quite a long time (for every dividend growth investor, companies like Visa and Apple are definitively worth a look).

But what I also like is Berkshire Hattaway’s huge cash pile of over USD 120 Bn!

The Corona Crisis Sell-Off in March put the B stocks of Berkshire Hattaway in a price range that caught my interest and I was more than happy to take a stake in that Wonderful Company early in April.

Investing in Google parent Company Alphabet

I am sure, each of us uses products and services of Alphabet on a daily basis.

People probably initially think of the search engine Google that gives us instant access to other websites around the world. Seventy percent of Alphabet’s revenues come from Google searches and user activity on platforms like Gmail, Google Maps, Google Play and YouTube. The vast majority of that money comes from ads.

But there is much more, like Chrome browser or the Android mobile operating system. Furthermore, Alphabet has made considerable investments in the Stadia cloud gaming system, Waymo self-driving vehicles, and other technologies.

Beside its huge economic moat, I like the company’s strong financials with a very robust profit growth while sitting on a cash pile of USD 130 Bn.

Alphabet certainly is not immune against the COVID-19 crisis as plenty of companies will reduce their ad spendings, but certainly I was happy to acquire pieces (Class A Stocks) of that wonderful business at a reasonable price.

What about you, fellow reader, did resp. do you take advantage of recent market volatility and acquired some stocks? How was your April in terms of Passive Income?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Pingback: April Dividend Income from YOU the Bloggers! - Dividend Diplomats

Pingback: April Dividend Income from YOU the Bloggers! | ResourceShark Blog