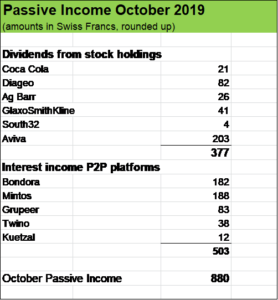

300 % year over year passive income jump

With another month in the books, it’s time for my update regarding our

- dividend income from our stock portfolio (market value roughly USD 300’000) and

- interest payments from Peer to Peer (P2P) platforms (currently roughly USD 55’000 invested).

Comparing the current passive income results with October last year, there was a very nice increase from USD 250 to now over USD 880!

The lion share of that growth was due to the recent establishment of our second Passive Income Machine consisting of different P2P platforms, which added handsomely to our income (see also post regarding the start of our P2P Portfolio).

Dividend income from strong companies in combination with interest payments through P2P investing is currently our basis for strong passive growth.

In the last ten months, we have collected roughly USD 12’000 in form of dividends and interests!

That’s pretty amazing, just thinking that on average, each month my wife and I receive USD 1’200 in fresh cash without breaking a sweat. Passive income generation is now significantly stronger than last year, when we received around USD 580 on average each month (our monthly passive income fluctuates on a monthly basis with the highest dividend income concentrated on April, May and June).

After SMASHING OUR 2019 PASSIVE INCOME GOAL in September, we are laying the ground for our next target: USD 20’000 by the end of 2020!!

Now, let’s have a look at our two Passive Income Machines and how they generated cash flows in October.

Robust organic passive income growth from October dividend contributors

Compared to last year, there is one new share position we recently added: Scottish soft drink maker AG Barr which contributed USD 26 in October. AG Barr makes its shareholder distributions twice per year, whereas the second semester dividend is the smaller one.

We have also been topping up our position in British insurer Aviva which is now one of our largest dividend contributor together with its peer Legal & General.

Average organic growth of our October dividend contributors has been almost 5 %. Let’s have closer look at their payout increases:

- Coca Cola: + 2.6 %

- Diageo: + 5 %

- AG Barr: 2.56 %

- Aviva: + 7.4 %

British pharma giant GlaxoSmithKline kept the dividend steady as did mining company South32 (spin-off of BHP Billiton). Last year, South32 also made a large special dividend that’s why this time our income from that company is lower compared to last year.

USD 500 from P2P platforms in October

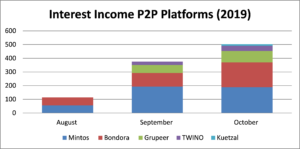

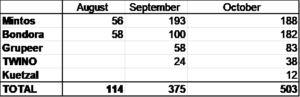

In August, we started investing on Mintos and Bondora and in September, we added TWINO and Grupeer to our P2P portfolio.

By the end of September, we made a further addition with Kuezal

Kuetzal, founded in Tallinn (Estonia) in July 2018 has its focus on business loans and financing of real estate projects.

Kuetzal is a good portfolio addition to diversify a bit away from our exposure to consumer loans (in particualar through our investments on Mintos, Bondora and TWINO).

Projects on Kuetzal are very interesting and attractive, and most of them are offered with some kind of investor protection mechanism (also called Buyback Guarantee although a bit different from the one I know from Mintos or TWINO).

I’ll write more about the Kuetzal platform and our experiences in my next blogposts.

Currently, we have USD 1’400 invested on Kuezal and it has already contributed USD 12 to our October passive income.

Growing cash flows from our five P2P platform investments

Received interests in October from Mintos, Bondora, TWINO, Grupeer and Kuetzal exceeded USD 500 which is 30 % higher than in the previous month.

Over the last three months, our P2P investments generated roughly USD 1’000. With around USD 55’000 invested, we expect these assets to generate roughly 10 % to 12 % per year, resp. roughly USD 6’000.

The main reason for higher interest income in October compared to the previous month is the fact that our invested funds on the different platforms (in particular on Grupeer and TWINO) could compound over a full month.

Mintos has once against been our strongest P2P income contributor despite the fact that our revenues fell from USD 193 in September to now USD 188. In October, we slighlty increased our investments by EUR 300 resp. USD 330 (currently we have over EUR 18’00 resp. USD 20’000 invested on the platform). I don’t think that we will add more funds. Mintos is a very fine, well established platform, offering huge diversification. Yields however have been falling quite strongly from 11.5 % to currently 10.6 % in a matter of just a few weeks. I think there a plenty of very nice alternatives to Mintos.

Bondora showed a strong interest income boost compared to the previous month, whereas in October we increased our investments by EUR 1’000 (USD 1’100) to now EUR 20’500 (roughly USD 22’500). The passive income boost from USD 100 in September to USD 182 in October was mainly driven by a change of the allocation of the funds we have invested on the platform: roughly two third of our funds is invested into the Bondora product “Go and Grow” (yielding 6.75 %) and the rest is invested via “Portfolio Manager”, offering higher returns but of course also with higher riks (in September, we had practically all our funds just in Bondora “Go and Grow”).

Let’s come to Grupeer. Currently, we have invested EUR 8’500 resp. USD 9’300 on that platform and in October these funds could generate interest income for the whole month, in contrast to September, where not all the funds have already been deposited on Grupeer. With investments yielding 13 %, very interesting projects and a buyback guarantee, it’s pretty clear for us, that we will consider increasing that position over the next months.

Income from TWINO showed a nice increase from USD 24 in September to USD 38. Currently, we have roughly EUR 4’500 resp. USD 5’000 on that platform. Our investments on TWINO yield almost 9.75 %, slightly lower than on Mintos. I am a bit ambivalent about the risk-reward-situation on TWINO. It’s a fine platform, but it has a higher platform risk than Mintos or Bondora in my view. TWINO doesn’t pair borrowers and investors (as Mintos), instead it issues/grants loans itself and sells (some of) them to investors via the platform. This aspect, TWINO has in common with Bondora. But Bondora on the other hand does not have a buyback guarantee which means, that Bondora has a significantly lower platform risk. Buyback guarantees are somewhat sweet for us investors, but they come at a price and can never completely mitigate our risks. By offering buyback – resp. payment guarantees, the financial strength of TWINO really is paramount. And as the financial records of the company show, TWINO has been struggling in the last few years. TWINO has taken some measures to get back on track but I will have an eye on our TWINO position and might scale back by the end of the year. So far, I also have to say, that our investments on TWINO are performing smoothly.

Looking ahead

With just two months to go in 2019, I see our total annual passive income at around USD 14’000 by the end of the year which is a huge achievement for us.

Our two Passive Income Machines are firing from all cylinders and through reinvestments and by putting our savings from our day jobs to work, the next milestone (USD 20’000) should be quite achievable.

Our strong passive income results also keep us motivated to shape our finances further and improve our savings rate, which currently stands at around 65 %. A HIGH SAVINGS RATE REALLY IS A TURBO TOWARDS FINANCIAL INDEPENDENCE.

The process of building wealth through a down to earth life style and by investing in different asset classes makes us strong, we learn a lot and it gives us options in life.

And of course it can make a lot of fun. It’s just amazing to see money now seriously starting working for us, instead of the other way around. Well, that’s the Magic of the Compound Effect.

How about you fellow Reader, how was your October passive income?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

As always, it’s extremely motivating to follow your financial journey! Sometimes it’s hard to believe, how fast your passive income is growing. That’s why I’m pretty sure, that you’ll achieve your 2020 goal as well! 🙂

As I read your October update, I noticed a significant difference in our accounting methods. While you assign your P2P interest income to the month, when they accrued, I currently wait until I’ll finally withdraw the money from the respective platform.

Hi David

Yes, indeed. One year ago, I would never have thought that it is possible for us to SMASH our USD 10’000 PASSIVE INCOME GOAL that fast and set the bar significantly higher to USD 20’000. Establishing a second Passive Income Machine has helped us a lot and P2P is quite specific in this aspect, that cash flows are almost immediately coming in, which is quite motivating.

Don’t let’s forget however that we my wife and I put substantial assets to work, by far exceeding our monthly savings, in fact, we have been putting money into P2P platform which my wife and I had initially intended to invest into real estate (our first house and/or a rental property). So, there is definitively a trade-off resp. to some extent a price we pay for that strong passive growth. But for my wife and I, the risk-reward-set-up is fine. A nice house where we live would easily costs in a range of USD 750’000 to 1 Mio. which would put us in a highly leveraged position. For us, it would not be worth the risk.

With regard to tracking our cash flows from the P2P platforms: yes, you are right, we let them accrue on the platforms, it’s extremely powerful to use the compound effect, giving a further boost month by month. I might transfer some funds back from platforms to my bank account e.g. to diversify on others or in case we would not feel comfortable anymore on a specific platform.

Glad that you are stopping by and thanks for your commentary!

nice shape.

The progress has been fast to say the least. I love the breakdown of all the different p2p platforms. Great income on that front.

Id like to get started with p2p one day.

keep it up

cheers

Hey there

Yes, we are very happy and grateful that cash flows from investments are coming in increasing quantities through multiple sources and on a continuous basis. Starting our P2P portfolio has definitively given us an enormous boost.

Thanks for stopping by and commenting.

Cheers

Wow 300% YoY is insane – nice job! Very inspiring post, really like the detailed info. Keep it going!

Regards,

Divcome

Hi Divcome!

Appreciate your supportive words a lot!

Thanks for swinging by and commenting.

Jesus that post was inspiring indeed!

Congrats on smashing your passive income goal, you really know how to shape your finances well hehe.

Interested in learning more about dividend investing so I am glad I stepped on your blog eventually hehe.

I think you’re making the right decision by increasing your position in Grupeer. This platform hasn’t delayed a single payment since I started over 17 months ago.

Cheers 🙂

Hi Tony

Many thanks! We really love the combination of dividend growth investing and P2P investing. And Grupeer is currently one of my favorite platforms, good projects and very consistent.

Cheers

Pingback: October Dividend Income from YOU the Bloggers! - Dividend Diplomats