Hey there, fellow reader.

It’s time for another monthly update on our dividend income and cash flows from Peer to peer (P2P) and crowdlending (P2P/CL) investments.

475 % Year over Year passive income boost

In November 2018, our passive income was USD 195 and now stands at USD 927. Almost five times higher!

Both of our Passive Income Machines contributed nicely to that growth:

- Dividend income more than doubled compared to the same month in the previous year and

- P2P/CL investing has been a game changer for our passive income generation ability (see how we started in August), generating over USD 550 per month.

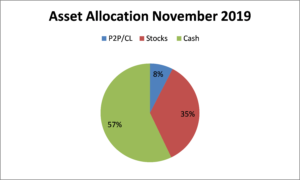

Let’s have a look at the asset allocation:

- Our stock portfolio (35 %), diversified in over 60 positions with a market value of over USD 300’000 has the potential to generate around USD 12’000 annually (net after taxes).

- Peer to Peer (P2P) resp. Crowdlending investments (CL) (8 %) in the amount of roughly USD 57’000 currently generate over USD 550 per month and have the potential to make us over USD 7’000 per year.

- Cash and deposits on the bank (57 %). A large Portion of that cash pile will be used to acquire rental properties in Central Europe and France over the next two years. We currently have zero debt and could certainly flex our financial muscles. Getting into real estate investing is a complex move which give our passive income generation a substantial boost. I am already looking forward to seeing rental income flowing in! We have our eye on two studios and a duplex. I’ll keep you updated.

Now, let’s have a look at dividend income in November and also at our cash flows from our P2P/CL Investments.

November marked a strong dividend month with good organic growth

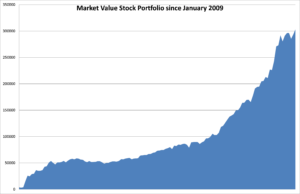

Dividend growth investing really has worked like clock work over the last years. What’s amazing is that since the start of our stock portfolio early in 2009, it took us seven years (until August 2016) to cross the USD 100’000 Milestone and just three years later the market value of our our share holdings stands at over USD 300’000 (!). The first steps are always the hardest, but once there is momentum and the magic of the compound effect kicks in, that’s when the real fun begins.

Well, the global stock bull market had a strong effect, of course. And we put substantial amounts of money to work quite regularily and reinvested the dividends.

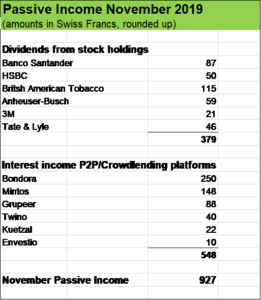

Now let’s come to our November 2019 dividend income.

Compared to the same month in the previous year, our dividend income grew by almost 100 % from USD 195 to USD 380.

That boost was driven by several factors:

- addition of Tate & Lyle (British supplier of food and beverage ingredients) and industrial giant 3M to our stock portfolio,

- doubling our positon in British American Tobacco,

- technical effect with regard to Banco Santander (changed its dividend distribution modus from quarterly installments to semestrial payouts) and

- dividend reinvestments.

In addition to these factors, there was also some nice organic divdend growth of our November contributors:

- British American Tobacco + 4 %

- Tate & Lyle + 2.3 %

- 3M + 6 %

- Banco Santander + 5 %

Bank giant HSBC and the world largest beer producer Anheuser Busch held their payouts steady.

Monthly P2P/CL income has grown to over USD 550

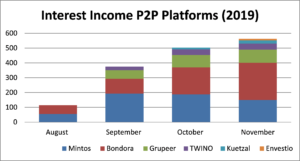

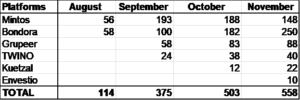

The growth of our P2P/CL portfolio is going on steadily:

- We started P2P investing in August with Mintos and Bondora and added TWINO and Grupeer in September.

- We then added crowdlending platform Kuetzal.

- Late in October, we made another additon with Envestio.

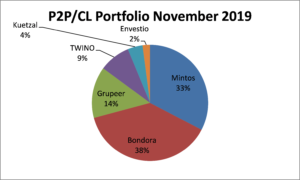

The allocation of currently six platforms in our P2P/CL portfolio is as follows:

Bondora (ca.USD 24’000) and Mintos (ca. USD 20’000) represent the largest constituents of our portolio.

Kuetzal (currently USD 2’400 on the platform) and Envestio USD 1’200 (currently USD 1’200 on the platform) are rather small positions in our P2P/CL portfolio, but they offer very attractive investment opportunities with very attractive yields (well above 15 %). Our investment process here is a bit different, compared to Mintos or Bondora with their vast offer of consumer loans. On Kuetzal and Envestio, there are specific business- and real estate projects. And there are not many of them. And they are usually funded in a very short time by investors. So, there is the tendency to rush in. But we will certainly take our time to study each project and only invest when we feel comfortable with the level of risk and reward. So, it will takes some time to build up diversified positions in Kuetzal and Envestio. So far, we have just invested a portion of the funds on these platforms.

But both, Kuetzal and Envestio are already contributing nicely to our passive income.

Now, let’s have a closer look at our six P2P/CL positions and their performance in November.

Platform Bondora is now by far our largest passive income contributor

Our investments on Bondora had a terrific run in November, generating USD 250 (EUR 227) compared to USD 182 in October. With over USD 22’500 (EUR 20’500) invested, there is the potential to generate USD 3’600 per year.

I allocate funds on Bondora as follows:

- 2/3 in “Go and Grow”, yielding 6.75 % and

- 1/3 invested via “Portfolio Manager” directly into loans issued by Bondora (much higher yield, but also less liquid and also with more risk).

There are now many high yielding loans in the portfolio and I know that it’s just a matter of time, when defaults really start to kick in and represent a drag to interest income generation.

On the other hand, one should never underestimate the compound effect, reinvesting interest income and having over EUR 14’800 (2/3 of our Bondora exposure) in “Go and Grow” should keep our passive income generation on Bondora quite stable over time. Well, time will tell whether I was right or not.

One should never forget that P2P/CL investing and investing in general ALWAYS come with risks. And these risks have to be addressed accordingly. Diversify as broadly as possible over asset classes, platforms etc. and never put money to work you need over the next years!

As far as Bondora is concerned, well, I am happy how our investments are currently performing.

Mintos – falling yield and problems with some loan originators

Mintos showed a weaker performance than in the previous months with USD 148 (EUR 135) compared to USD 188 in October.

There were two reasons for that 22 % monthly passive income drop on Mintos:

- yields have been falling from 12 % to now 10.3 % in a matter of just three months (I guess due to high demand, seasonal effects etc.).

- several loan originators had problems, the latest one was Metrokredit (not allowed any more to issue new loans anymore). I decided to stopp investing through “Invest & Access” and switched to Auto-Investment programs, which I calibrated to choose loans from loan originators with better financial fundamentals. Being much more selective reduces risks, but it comes with a price in form of opportunity costs. Over EUR 1’200 has not been invested for several weeks! I also got rid of all my Metrokredit position (over EUR 500) by selling them on the Secondary Market. I had to grant a discount of 1 % on some of these loans and realised a loss of EUR 4.42! But at least I got EUR 532.69 of my EUR 537.11 loan investments issued by Metrokredit immediately back in cash.

The whole Metrokredit issue serves me well as a valuable experience.

Metrokredit is a smaller player, it represented only 3 % of our loan investments on Mintos which is perfectly manageable. But just imagine that two or three larger loan originators went bust in a shorter time period! It would be impossible to sell affected loans and it would take years to recover.

So, again, diversification and focus on quality are key.

Grupeer showed another strong month

Grupeer has become one of my favorite platforms, it’s performing smoothly and offers very interesting projects.

Currently, we have EUR 8’500 (USD 9’300) invested, no change compared to the previous month.

We are considering topping up that position at the beginning of next year to the amount of roughly EUR 10’000 which will give a nice boost to our passive income.

Twino has shown a robust performance so far

Yield on investments has been steadily increasing from 9.5 % two monts ago to now over 10.4 %. Risk-reward-profile now looks better.

We decided to leave our investment on TWINO (around USD 5’500) unchanged for the moment and will decide early in 2020, whether we will continue that position or transfer funds to another platform.

As stated in one of my latest blogpost, I am quite ambivalent about TWINO, but currently our investments on that platform are performing fine.

Crowdlending platform Kuetzal is now contributing nicely

Last month, Kuetzal has been added to our P2P/CL portfolio and I really like that platform. Offering yields above 15 %, it’s pretty clear, that investments on Kuetzal are risky. On the other hand, business- and real estate projects provide us with a nice diversification effect given our strong consumer loan exposures especially via Mintos, TWINO and Bondora.

We have around USD 2’400 on the platform and are considering doubling that position over the next few months. I’ve invested into business loans and real estate projects which have a “buyback guarantee” meaning that Kuetzal promises to buy back a bad loan from investors after two months.

Envestio a “high risk – high reward” crowdlending addition

Envestio is quite similar to Kuetzal, offering real estate – and business loans.

Envestio has very nice projects with very attractive yields as well.

Currently, we have USD 1’200 on that platform, only a small fraction has already been put to work through projects and I am considering to triple that new position over next months but will almost certaily cap it at USD 4’000.

Looking ahead to December

We will smash USD 12’000 in passive income by the end of the year, that’s almost certain and I’m already looking forward to take off towards our next big Milestone: USD 20’000 by the end of 2020.

There will be two more P2P/CL additions I will cover in my next passive income update. And I will also share some news with regard the build up of a third Passive Income Machine: real estate properties which will provide us with rental income.

So, stay tuned and thanks for reading.

How about you fellow Reader, how was your November passive income?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Pingback: November Dividend Income from YOU the Bloggers! - Dividend Diplomats