The start of a NEW YEAR is always a great opportunity to look back and make new plans.

Our family of four is well on the way towards Financial Independence by 2024, but 2020 put us back in terms of building reliable and ever growing Passive Income Streams which are supposed to sustain our living costs in future.

A Big Earning Miss

The COVID-19 pandemic clearly had a strong impact on cash revenues from our investments.

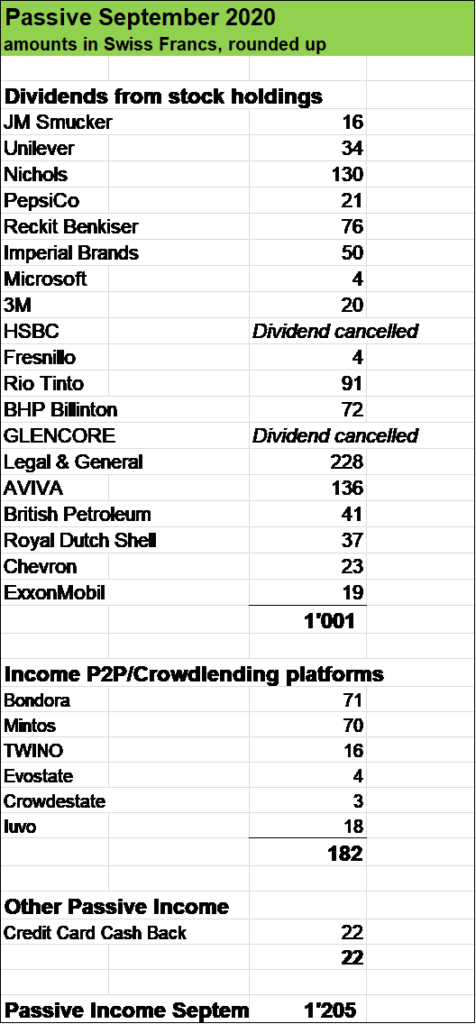

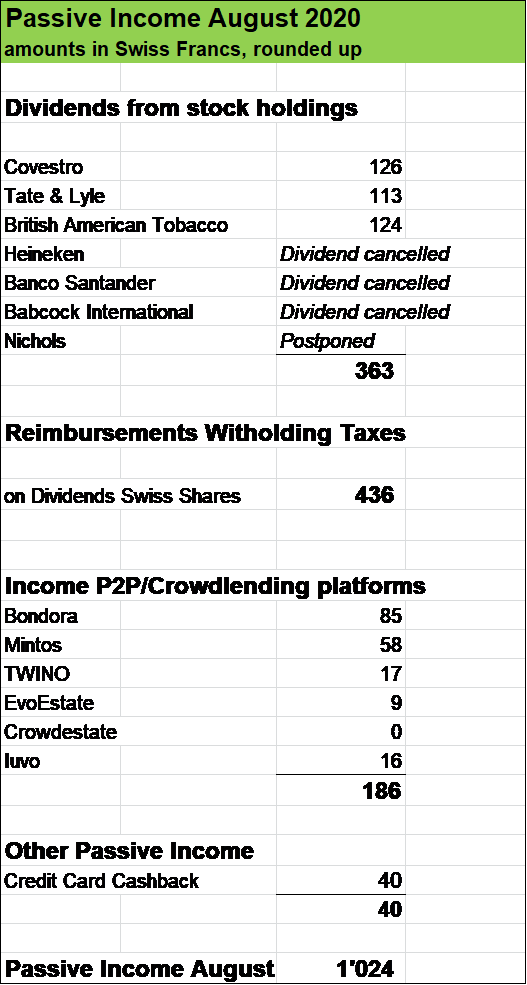

While in 2019, our Dividend Paying Stock Portfolio plus our Peer to Peer and Crowdlending investments (P2P/CL) through plaforms like Mintos, Bondora, TWINO etc. generated over USD 14’000 in passive income, 2020 showed a different picture: in fact, Total Passive Income has been significantly lower with under USD 10’000. Initially, my wife and I had targeted USD 20’000 in passive income for 2020.

So, which factors led to that Huge Earning Miss of over 50 %?

- Amid the COVID-19 pandemic and the economic effects of lockdowns worldwide, several company elimintaed their dividend payments in order to preserve cash (e.g. in the case of The Walt Disney Company, HSBC, GLENCORE etc.). Other businesses reduced their shareholder distributions signifcantly (e.g. in the case of UK soft drink producers Nichols, BRITVIC, AG Barr). So, dividend eliminations and cuts led to a 13 % lower total Net Dividend Income compared to the previous year DESPITE the fact that in March and April 2020 we had added several strong dividend payers such as Swiss Life, Fevertree etc.

- The largest adverse impact came tho from our P2P and Crowlending investments. These generated roughly USD 3’500 in interest income through 2020, but on the other hand, an equal amount had to be written down due to the collapse of the two platforms Kuetzal and Envestio early in 2020, as well as due the failure of Grupeer. So, in 2020, all in all a zero sum game in terms of Passive Income Generation.

- Another factor was the adaption of our investment strategy. We made significant cash withdrawals (more than USD 40’000 in the last few months alone) from our P2P/CL platforms and invested these funds into Tech Companies such us Amazon, Apple, Facebook, Fiverr, Etsy etc. In terms of wealth building, this has shown to be a good move, looking at very nice book gains of almost 30 % in total, but on the other hand withdrawals weakened interest generating capabilites of our P2P/CL platforms (by beginning of 2020, more than USD 60’000 were invested, by the end of that year, this has been reduced to less than USD 20’000).

Financial priority shift amid the pandemic

We made several changes in 2020, a year full of uncertainties.

We took the decision to boost our cash pile and slash spendings in order to increase our savings rate .

We also wanted to become more diversified in terms of investments, that’s also one reason, why we built our Tech Portfolio while reducing P2P/CL investments.

Initially, we had planned to buy real estates in France, we would then rent out and generate passive income. Well, COVID-19 put that plan on a hold. We will of course stick to our plan to buy properties abroad and are quite confident that 2021 we will be successful.

So, a lot of things going on in terms of our financials and there were definitively a couple of bright spots:

Our Savings Rate trough 2020 was very robust. In fact, we went through the year on a Savings Rate of 66 % on average. That’s a very nice chunk of cash we have been able to extract from our salaries and income streams in form of savings.

Despite the fact, that our dividend stock portfolio generated 13 % less in 2020 compared to 2019, the book value of these investments recoverd from a huge fall in March 2020. It had fallen from USD 310’000 to USD 220’000 in a couple of just a few weeks and steadily climbed back to around USD 275’000 by the end of 2020. Still a book loss of over 10 %, but in combination with nice book gains of over 30 % on our Tech Portfolio, the overall result is quite acceptable. In particual considering the fact, that still, almost USD 10’000 in Passive Income had been generated on top of that book value performance.

So, all in all, we came through the pandemic financially stronger and more flexible, with almost USD 400’000 in investments (dividend stocks, tech holdings, Peer to Peer lending etc.), which represents around 40 % of our total wealth.

Roughly 60 % of our total wealth is kept in cash (in Swiss francs) to remain flexible to seize interesting investment opportunities anytime they arise. A big chunk will be used to acquire real estates abroad, once we can travel again.

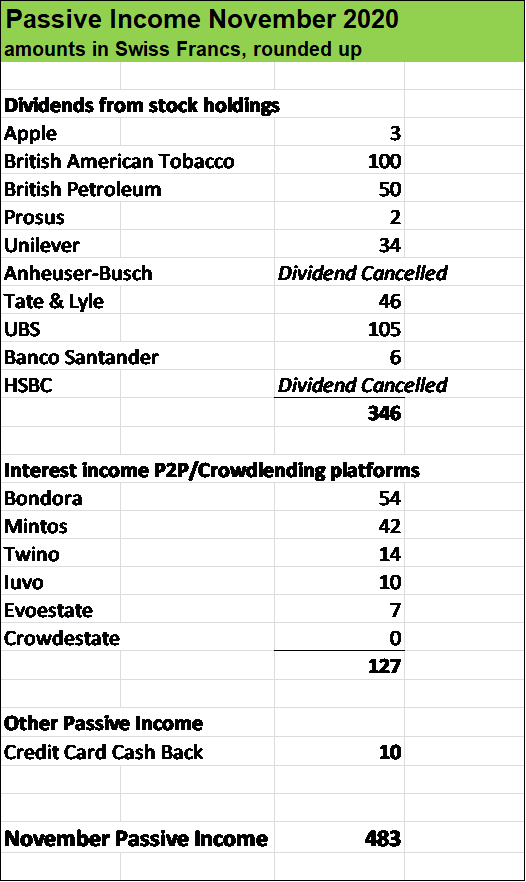

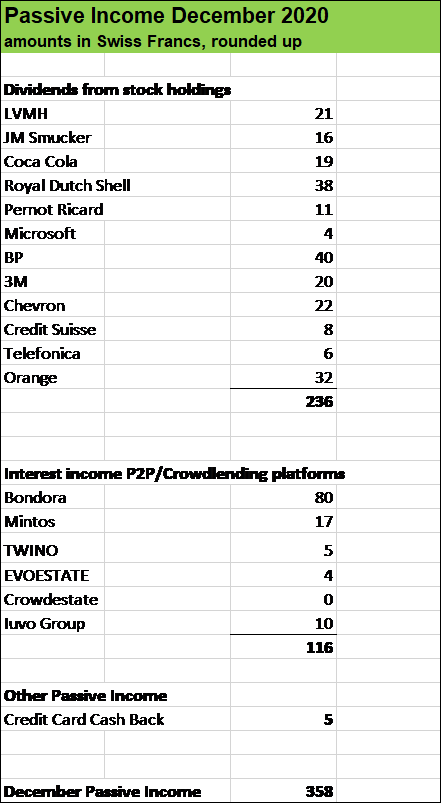

A brief look at December 2020 Passive Income

December performed poorly on a Year over Year basis with Passive Income roughly two third lower than in the same month in 2019 (2020: 358 versus 2019: 1’242).

Several changes in terms of dividend payment dates make it hard to compare with December 2019, e.g. the traditionally strong dividend payer Imperial Brands transferred its shareholder payments in January instead of December.

P2P/ CLinvestments generated USD 116 which is a quite decent monthly income from the roughly USD 20’000 but still, if you compare with USD 727 in December 2019, significantly lower. But again, the P2P and Crowdlending Porfolio is now much smaller (20’000 versus almost 70’000 by end 2019).

Looking ahead to 2021

So, all in all 2020 hit our Passive Income Generators quite hard. But the world economy will recover from the COVID-10 pandemic, and so will our Dividend Stock Portfolio.

We withdrew tens of thousands from P2P and Crowdlending platforms, so clearly this Passive Income Machine will generate reduced revenues, and our Tech Portfolio consists of businesses which don’t pay any dividends (with the exemption of Microsoft, Apple and Prosus).

But we will continue adding Dividend Paying Stocks here and there and several traditionally strong Contributors will resume their shareholder distributions this year.

So, we plan for Total Passive Income for 2021 to be at least USD 15’000 in total, which is roughly 50 % higher than in 2020, and roughly 7 % on top of what our total investments generated in 2019.

What about you, fellow Reader, how was your 2020 in terms of passive income? Which goals did you set for the New Year?

Thanks for reading my post and for sharing your thoughts.

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.